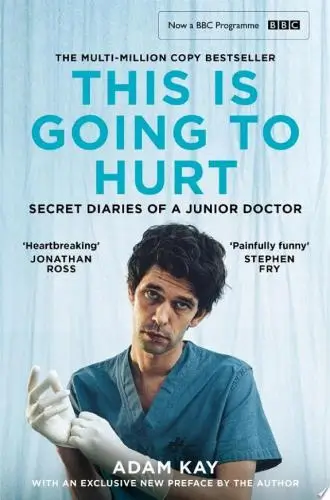

Rich Dad Poor Dad

What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

What's it about?

Rich Dad Poor Dad is a personal finance classic that challenges conventional beliefs about money. Robert T. Kiyosaki shares his childhood experiences with two father figures: one, his biological "poor dad," who believed in traditional education and job security, and the other, his friend's "rich dad," who taught him about investing and financial independence. This book emphasizes the importance of financial education, assets vs. liabilities, and the mindset needed to achieve wealth. It's a must-read for anyone looking to break free from the rat race and build a prosperous future.

About the Author

Robert T. Kiyosaki is an influential American author and businessman best known for his book "Rich Dad Poor Dad." His work emphasizes financial education, investment, and the importance of creating passive income. Kiyosaki's writing combines personal anecdotes with practical advice, advocating for financial literacy and independence.

10 Key Ideas of Rich Dad Poor Dad

Understand the Difference Between an Asset and a Liability

An asset puts money in your pocket, whereas a liability takes money out.

To build wealth, focus on acquiring assets such as real estate, stocks, bonds, and intellectual property that generate income or appreciate over time.

Avoid accumulating liabilities like excessive debt or items that depreciate and incur additional costs.

This fundamental understanding is crucial for financial growth and stability.

Learn DeeperTrack Your Spending: Start by keeping a detailed record of where your money goes each month. Identify which expenses are for assets (things that could make you money) and which are for liabilities (things that cost you money).

Invest in Education: Spend time learning about different types of investments such as stocks, bonds, real estate, and others. Knowledge is a powerful asset that can generate returns by helping you make informed decisions.

Create a Budget Focused on Asset Accumulation: Allocate a portion of your income towards purchasing assets. This could mean setting aside money for stock investments, saving for a down payment on a rental property, or investing in courses that enhance your skills and career prospects.

Evaluate Purchases by Their Asset Potential: Before making a purchase, ask yourself if it's an asset or a liability. For example, buying a car for personal use might be a liability (depreciates and incurs costs), whereas buying a car to use in a ride-sharing service could be an asset (generates income).

Start Small and Scale Up: Begin with small investments that you're comfortable with and gradually increase your investment as you gain confidence and experience. This could mean starting with a small amount of stock or a share in a real estate investment trust (REIT) before buying property outright.

- Example

If you receive a bonus at work, instead of spending it on a luxury vacation (a liability), you could invest a portion of it into a mutual fund or stocks (an asset). Over time, these investments could grow and potentially provide additional income.

- Example

Instead of buying the latest smartphone model every year (a liability), consider using your phone for a longer period and investing the money you would have spent into an online course that teaches you a new, marketable skill (an asset).

Work for Experience, Not Just Money

Early in your career, prioritize jobs that offer valuable skills and experiences over those that may offer higher pay but fewer learning opportunities.

Skills such as sales, marketing, negotiation, and management are transferable and can significantly enhance your ability to generate income across various ventures.

This approach accelerates your path to financial independence by equipping you with the tools needed to succeed in any business environment.

Learn DeeperIdentify Skills You Want to Learn: Start by making a list of skills that you believe will be beneficial for your career in the long run. Consider areas like communication, leadership, financial analysis, or any specific technical skill relevant to your field.

Seek Opportunities That Offer These Skills: Look for job positions, internships, or volunteer opportunities that provide a platform to learn and practice these skills. Don't focus solely on the salary; consider the learning potential and growth opportunities.

Take Initiative in Your Current Role: If changing jobs isn't an option, take initiative in your current position to acquire new skills. Ask to be involved in projects outside of your immediate responsibilities or propose new initiatives that allow you to develop and showcase your desired skills.

Invest in Continuous Learning: Beyond your job, invest time and resources in learning. This could be through online courses, workshops, seminars, or reading books related to the skills you want to acquire. Continuous learning keeps you competitive and versatile in the job market.

Network with People Who Have the Skills You Desire: Networking is not just for job hunting. It's also a way to learn from others. Seek out mentors or colleagues who excel in the areas you're interested in and ask for advice, feedback, or even shadowing opportunities.

- Example

A marketing graduate takes a job at a startup instead of a higher-paying corporate position because the startup role offers hands-on experience in multiple aspects of marketing, from social media campaigns to direct customer engagement.

- Example

An IT professional volunteers to lead a cross-department project at their company, despite it not offering immediate financial rewards. This experience allows them to develop project management and leadership skills, making them a more valuable asset to their employer and enhancing their future career prospects.

Make Your Money Work for You

Instead of solely relying on earned income from a job, invest in income-generating assets that work for you even when you're not actively working.

This includes investments in stocks, bonds, rental properties, or businesses that do not require your daily presence.

By creating multiple streams of passive income, you reduce dependence on a paycheck and gain financial freedom.

Learn DeeperStart with a Budget: Before you can invest, know how much money you have to work with. Dedicate time each month to review your income and expenses. Identify areas where you can cut back to free up more money for investments.

Educate Yourself: Spend time learning about different types of investments such as stocks, bonds, real estate, or starting a side business. Use resources like books, podcasts, and online courses to build your knowledge.

Open an Investment Account: If you're interested in stocks or bonds, open a brokerage account. Many platforms offer low fees and the ability to start with small amounts of money.

Consider Real Estate: For those interested in real estate, research rental properties or real estate investment trusts (REITs) as a way to generate passive income.

Start Small and Diversify: Begin with investments you can afford, even if they're small. Over time, diversify your portfolio across different assets to spread risk.

Automate Your Investments: Set up automatic transfers from your checking account to your investment accounts to make investing effortless. This ensures you consistently invest without having to think about it each month.

Seek Professional Advice: If you're unsure where to start, consider consulting with a financial advisor who can help tailor an investment strategy to your personal goals and financial situation.

- Example

Jane, a graphic designer, decides to allocate $200 every month into a diversified portfolio of index funds through her online brokerage account. Over time, this habit helps her build a substantial nest egg.

- Example

Alex and Sam, a couple, purchase a small duplex. They live in one unit and rent out the other. The rental income covers their mortgage and property expenses, effectively allowing them to live for free while building equity in the property.

Understand Taxes and Leverage Them to Your Advantage

Educate yourself on how taxes work and the implications for different types of income and investments.

Use legal strategies to minimize tax liabilities, such as investing in tax-advantaged accounts (e.g., IRAs, 401(k)s) or utilizing deductions and credits available for investments.

Knowledge of tax laws can significantly increase your net income and investment potential.

Learn DeeperReview Your Current Financial Situation: Take a close look at your income, investments, and any potential tax liabilities. Understanding where you stand financially is the first step in leveraging taxes to your advantage.

Educate Yourself on Tax Laws: Spend time learning about the different tax laws that apply to your situation. This could include understanding how different types of income are taxed, what deductions and credits you might be eligible for, and how investment gains are treated.

Consult with a Tax Professional: Consider hiring a tax advisor or accountant who can provide personalized advice based on your financial situation. They can help you identify strategies to minimize your tax liabilities and take advantage of any available tax benefits.

Invest in Tax-Advantaged Accounts: Maximize contributions to accounts like IRAs and 401(k)s, which offer tax benefits such as tax-deferred growth or tax-free withdrawals in retirement.

Keep Records of All Deductible Expenses: Maintain detailed records of expenses that could qualify for tax deductions or credits, such as educational expenses, healthcare costs, or charitable donations. This will make it easier to claim these benefits come tax time.

- Example

If you're self-employed, setting up a retirement plan like a SEP IRA can allow you to save for retirement while reducing your taxable income.

- Example

Investing in real estate can provide tax advantages through depreciation, mortgage interest deductions, and potentially deferring capital gains through mechanisms like a 1031 exchange.

Learn to Take Calculated Risks

Wealth creation involves taking risks, but they should be calculated and informed.

Educate yourself thoroughly before making investment decisions, understand the risk/reward ratio, and never invest in something you don't understand.

Diversifying your investments can also help manage risk.

Taking smart risks is essential for achieving significant financial gains.

Learn DeeperStart with Small Investments: Begin your investment journey with smaller amounts. This allows you to learn the ropes without putting yourself at significant financial risk. For instance, if you're interested in the stock market, start with a small portfolio that you can afford to lose.

Educate Yourself Continuously: Make it a habit to read books, attend workshops, or take online courses about investing and financial management. The more you know, the better equipped you'll be to make informed decisions and take calculated risks.

Analyze Before You Leap: Before making any investment, spend ample time researching the opportunity. Look into the company's or asset's history, performance, and potential future growth. Understanding these aspects can help you make a more informed decision.

Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different assets, such as stocks, bonds, real estate, or even new ventures. Diversification can reduce risk and increase the chance of a return on your investments.

Set Clear Financial Goals: Know what you're investing for. Whether it's retirement, buying a home, or starting a business, having clear goals can help you make better investment choices and assess the level of risk you're willing to take.

- Example

If you're interested in the stock market but wary of the risk, you might start by investing in a low-cost index fund. This allows you to gain exposure to the market with a diversified set of stocks, reducing the risk associated with individual stock investments.

- Example

Consider someone who wants to invest in real estate but doesn't have much capital. They might start with a Real Estate Investment Trust (REIT), which allows them to invest in real estate with a much lower entry point, learning about the market before making larger, direct property investments.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

Rich Dad Poor Dad Summary: Common Questions

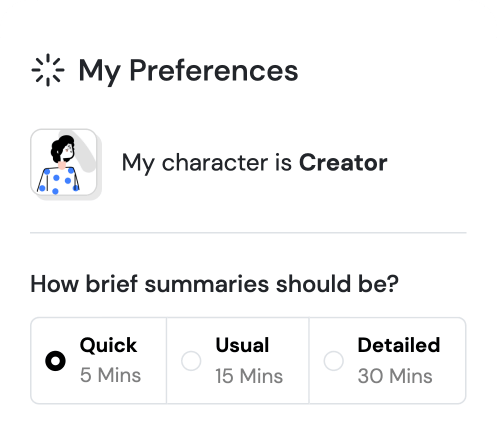

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh