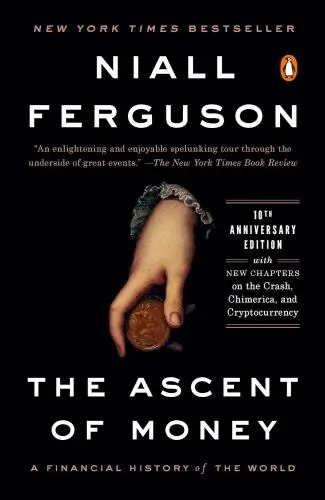

The Ascent of Money

A Financial History of the World

What's it about?

The Ascent of Money offers you a compelling journey through the history of finance. Discover how the evolution of money has shaped civilizations and influenced the world as we know it. You'll explore the origins of banking, the rise of bonds, the stock market, and the modern insurance industry. Ferguson reveals how financial innovations have fueled advancements but also led to crises. This book equips you with a deeper understanding of the financial forces that drive the world, highlighting both their power and peril.

About the Author

Niall Ferguson is a Scottish historian and author known for his expertise in financial and economic history, as well as his analysis of historical empires. His works, including "The Ascent of Money" and "Empire: How Britain Made the Modern World," often interweave historical narratives with contemporary economic and political insights.

10 Key Ideas of The Ascent of Money

The Evolution of Money: From Barter to Digital Currencies

Money has evolved from physical bartering systems, where goods were directly exchanged, to the use of precious metals, paper currency, and now digital forms like cryptocurrencies.

This evolution reflects the increasing complexity of economies and the need for more efficient means of transaction.

The shift towards digital currencies is driven by the desire for faster, more secure transactions and the reduction of physical cash handling costs.

As economies continue to digitize, understanding the history and potential future of money is crucial for navigating financial landscapes.

Learn DeeperEducate Yourself on Digital Currencies: Start by learning the basics of cryptocurrencies and blockchain technology. There are numerous free resources online, including courses, webinars, and articles that can provide a solid foundation.

Experiment with Small Transactions: Once you have a basic understanding, consider setting up a digital wallet and conducting small transactions to get a feel for how digital currencies work. This could be as simple as buying a small amount of cryptocurrency or using a digital wallet to make a purchase.

Stay Informed About Security Practices: With the convenience of digital transactions comes the risk of cyber threats. Make it a habit to stay informed about the best practices for securing your digital wallet and transactions. This includes using strong, unique passwords and enabling two-factor authentication whenever possible.

Explore Digital Payment Options: Look into digital payment options available for your regular transactions, such as bill payments, online shopping, and even peer-to-peer transfers. Many services now accept digital currencies or offer their own digital wallets, which can streamline and secure your transactions.

- Example

Signing up for a cryptocurrency exchange platform like Coinbase or Binance to buy a small amount of Bitcoin or Ethereum. This will give you firsthand experience with the process of buying, selling, and holding digital currencies.

- Example

Using a service like PayPal, Venmo, or Apple Pay for everyday transactions, which can introduce you to the convenience and security of digital payments without diving fully into cryptocurrencies.

The Importance of Financial Institutions in Economic Development

Financial institutions, including banks, investment funds, and insurance companies, play a pivotal role in economic development.

They facilitate the allocation of resources, provide the infrastructure for payment systems, and mobilize savings for investment.

By offering credit, these institutions enable businesses to expand and innovate, leading to economic growth.

Moreover, they provide mechanisms for risk management, helping individuals and companies to protect against unforeseen financial setbacks.

Understanding the functions and importance of these institutions can help individuals and policymakers foster a more robust economic environment.

Learn DeeperReview your banking and investment relationships. Take a closer look at where you bank and how you invest. Are you maximizing the benefits these institutions offer? For example, does your bank offer competitive interest rates on savings accounts or tools for better managing your finances? Are your investments diversified across different funds to spread risk and potential for growth?

Educate yourself on credit and insurance options. Understanding the types of credit available (such as personal loans, credit cards, and mortgages) and how to use them responsibly can be a game-changer for your financial health. Similarly, familiarize yourself with different insurance products to ensure you and your assets are adequately protected against unforeseen events.

Start or join an investment club. This can be a practical way to learn more about how investment funds work and gain firsthand experience in making investment decisions in a low-risk environment. It’s also a great way to share knowledge and strategies with peers.

Create a personal risk management plan. Assess your current financial situation to identify potential risks (like job loss, health issues, etc.) and determine how best to mitigate them. This might involve setting aside an emergency fund, diversifying your income sources, or getting the right insurance coverage.

- Example

Imagine you're planning to start a small business. By understanding the role of financial institutions, you could approach a bank for a small business loan to cover startup costs, knowing exactly what kind of documents and financial records you need to present. Additionally, you might decide to protect your new venture with business insurance, mitigating risks from potential future uncertainties.

- Example

Consider a scenario where you're looking to buy your first home. With a solid grasp of how mortgage lending works, you could shop around for the best mortgage rates and terms, potentially saving thousands over the life of the loan. You might also explore different types of insurance, like homeowners and title insurance, to protect your investment.

The Impact of Stock Markets on Global Economies

Stock markets are crucial components of the global financial system, acting as barometers for economic health and facilitating wealth creation.

They provide a platform for companies to raise capital by issuing shares, and for investors to acquire ownership stakes, potentially earning dividends or realizing capital gains.

The liquidity and efficiency of stock markets enable the allocation of resources to their most productive uses, driving economic growth.

However, they can also be sources of volatility, as seen in financial crises.

Understanding stock market dynamics is essential for investors and policymakers alike.

Learn DeeperStart small with stock investments: Begin by investing a small, manageable amount of money in the stock market to get a feel for how it works. Use online platforms or apps that allow you to buy fractional shares in companies you're interested in.

Educate yourself on market trends and financial news: Stay informed about the economic health and performance of various sectors. Subscribe to financial news outlets, follow market analysts on social media, or use apps that provide daily market summaries.

Diversify your investment portfolio: Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes (stocks, bonds, real estate) to mitigate risk and increase the potential for returns.

Set long-term financial goals: Think about what you're investing for—retirement, a home, education—and tailor your investment strategy to meet those goals. This helps in making informed decisions rather than reacting to short-term market volatility.

Monitor and review your investments regularly: Check your investment performance periodically, but don't obsess over daily fluctuations. Adjust your portfolio as needed based on changes in your financial goals or in response to significant market shifts.

- Example

If you're interested in technology, you might start by investing a small amount in a tech ETF (Exchange-Traded Fund) that gives you exposure to a broad range of tech companies, from giants like Apple and Google to smaller, emerging tech firms.

- Example

Consider setting up a monthly automatic transfer from your checking account to your investment account to consistently invest in your chosen stocks or funds. This strategy, known as dollar-cost averaging, can help reduce the impact of market volatility.

The Role of Bonds in Financing Governments and Corporations

Bonds are critical tools for financing government projects and corporate expansion.

By issuing bonds, governments and corporations can borrow from investors with the promise of periodic interest payments and the return of principal at maturity.

This mechanism allows for the funding of infrastructure, public services, and business growth without immediately raising taxes or diluting equity.

Bond markets also offer investors a way to earn returns while managing risk, contributing to financial stability.

Recognizing the significance of bonds can enhance strategies for investment and fiscal policy.

Learn DeeperStart by educating yourself about bonds. Dive into resources that explain how bonds work, the different types (such as government, municipal, and corporate bonds), and their risk levels. Understanding these basics will help you make informed decisions.

Consider adding bonds to your investment portfolio. Depending on your risk tolerance and investment goals, bonds can offer a stable income through interest payments. Evaluate how bonds can diversify your investments and potentially lower overall risk.

Keep an eye on interest rates and market conditions. Interest rates have a significant impact on bond prices and yields. By staying informed, you can better time your bond investments to optimize returns or minimize losses.

Use online platforms or consult with a financial advisor. Many online platforms offer tools for buying and selling bonds. Alternatively, a financial advisor can provide personalized advice based on your financial situation and goals.

- Example

If you're looking to invest in bonds, you might start by purchasing U.S. Treasury bonds through the TreasuryDirect website. These are considered low-risk investments since they're backed by the U.S. government.

- Example

For those interested in corporate bonds, using an investment platform like Vanguard or Fidelity to buy and sell bonds of various corporations can be a practical approach. This allows you to research and compare different corporate bonds based on yield, maturity, and credit rating.

Insurance: A Pillar of Economic Security

Insurance plays a fundamental role in providing economic security by allowing individuals and businesses to manage risks related to health, property, and other unforeseen events.

Through the pooling of risks and the law of large numbers, insurance companies can offer policies that mitigate the financial impact of losses.

This protection supports economic stability by preventing catastrophic financial losses for policyholders and facilitating investment and consumption.

Understanding insurance mechanisms is vital for personal financial planning and the development of resilient economies.

Learn DeeperAssess Your Insurance Needs: Regularly evaluate your life stage and associated risks to determine what types of insurance (health, property, life) you need. For instance, if you've just bought a house, prioritize homeowners' insurance.

Shop Around for Insurance Policies: Don't settle for the first policy you come across. Compare policies from different companies to find one that offers the best coverage for your needs at a reasonable price.

Understand Your Policy: Take the time to read and understand your insurance policy. Know what is covered and what isn't, and how to file a claim. This knowledge can save you from unexpected financial burdens in the future.

Consider an Emergency Fund: Besides insurance, build an emergency fund to cover smaller, unforeseen expenses. This reduces the need to file small claims, which can increase your premiums.

Review and Update Your Coverage: Life changes, such as getting married, having children, or buying a property, can affect your insurance needs. Review and update your coverage accordingly to ensure it remains adequate.

- Example

If you're a freelancer with no employer-provided health insurance, researching and purchasing a comprehensive health insurance policy can protect you from devastating healthcare costs in case of an illness or accident.

- Example

After purchasing a new car, instead of just opting for the legal minimum liability insurance, comparing different full coverage options can ensure that you're not only protecting others but also your investment in your vehicle.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Ascent of Money Summary: Common Questions

"Ironically, then, financial history is the fractal geometry of the kaleidoscopic world of money."

I just finished reading The Ascent of Money by Niall Ferguson, and I was captivated by the way he weaves together economics, politics, and culture to explain the evolution of money. Ferguson's exploration of financial innovations, from the origins of banking to the complexities of modern derivatives, kept me hooked as he delved into the impact of history on our current financial system.

The book left me with a deeper understanding of the role money plays in shaping societies and economies. If you enjoy non-fiction books that blend history and economics, I highly recommend diving into this insightful read.

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh