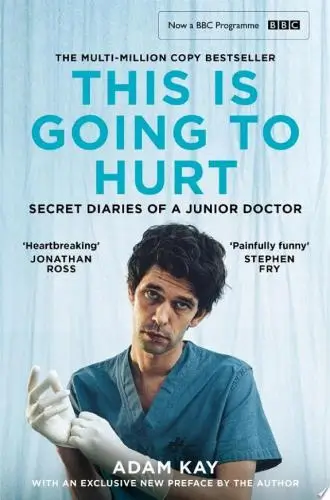

The Millionaire Next Door

The Surprising Secrets of America's Wealthy

What's it about?

The Millionaire Next Door unveils the surprising secrets of America's wealthy. Authored by Thomas J. Stanley, this book challenges common stereotypes, revealing that the typical millionaire lives a life of frugality and discipline. Through engaging stories and rigorous research, it teaches vital lessons on how the accumulation of wealth is more about smart financial habits than high income. A must-read for anyone looking to understand the true path to financial independence.

About the Author

Thomas J. Stanley was an American author and researcher, best known for his work on the affluent in America. His seminal book, "The Millionaire Next Door," co-authored with William D. Danko, explores the common traits of America's financially successful individuals, emphasizing frugality and long-term wealth accumulation strategies.

10 Key Ideas of The Millionaire Next Door

Live Below Your Means for Long-term Wealth Accumulation

The foundation of accumulating wealth is spending less than you earn.

This tactic involves budgeting, avoiding unnecessary expenses, and prioritizing savings and investments over luxury purchases.

By living below your means, you can allocate more resources to investments that will grow over time, leveraging the power of compound interest.

This approach also prepares you for financial emergencies and reduces the stress associated with living paycheck to paycheck.

Learn DeeperTrack Your Spending for a Month: Keep a detailed record of every penny you spend. This will help you identify unnecessary expenses that you can cut back on.

Create a Budget That Prioritizes Savings: After tracking your spending, create a budget that allocates a significant portion of your income to savings and investments before covering other expenses.

Automate Your Savings: Set up automatic transfers from your checking account to your savings and investment accounts. This ensures you save first rather than treating savings as an afterthought.

Live Modestly: Choose a home and car that are well within your means. Avoid the temptation to upgrade your lifestyle whenever your income increases.

Avoid Debt for Depreciating Assets: Steer clear of high-interest debt, especially for purchases that lose value over time, like cars or electronics.

- Example

If you receive a $5,000 bonus at work, instead of splurging on a luxury vacation, you could allocate 80% ($4,000) of it to your investment account and 20% ($1,000) to a modest celebration or purchase.

- Example

Instead of dining out four times a week, reduce it to once a week, allocating the money saved into a high-yield savings account or an index fund, leveraging compound interest over time.

Emphasize Financial Independence Over Displaying High Social Status

Prioritizing financial independence over the need to display wealth through expensive goods and lifestyles is crucial.

Many wealthy individuals prefer a modest, unassuming lifestyle that allows them to save and invest their money rather than spend it on conspicuous consumption.

This strategy not only helps in wealth accumulation but also in maintaining privacy and security.

It's about valuing long-term financial health over short-term social recognition.

Learn DeeperTrack Your Spending: Start by keeping a detailed record of where your money goes each month. This will help you identify areas where you can cut back on unnecessary expenses and redirect those funds towards savings or investments.

Create a Budget That Prioritizes Savings: Allocate a portion of your income to savings and investments before you budget for any other expenses. This 'pay yourself first' approach ensures that you're consistently building your wealth.

Live Below Your Means: Resist the temptation to upgrade your lifestyle with every raise or bonus. Instead, maintain a modest lifestyle and use extra income to strengthen your financial position.

Invest in Appreciating Assets: Focus on putting your money into investments that are likely to appreciate over time, such as stocks, bonds, or real estate, rather than spending it on depreciating assets like cars or gadgets.

Avoid Debt for Depreciating Assets: Try not to take on debt for items that lose value. If you need to borrow, reserve it for investments like education or a home, which can increase your net worth over time.

- Example

Instead of leasing a new luxury car every few years, opt for a reliable, fuel-efficient model that's more affordable. Invest the money you save on car payments into a diversified stock portfolio.

- Example

Rather than moving into a larger, more expensive home as soon as you get a raise, stay in your current home and invest the extra income. Over time, this strategy can significantly increase your financial security and independence.

Allocate Time, Energy, and Money Efficiently Towards Wealth Building

Effective wealth building requires a strategic allocation of your resources.

This means dedicating time to financial education, planning, and management.

Energy should be focused on increasing earning potential through career advancement or entrepreneurial endeavors.

Money should be allocated towards savings, investments, and assets that appreciate or generate income over time.

This holistic approach ensures a balanced and sustainable path to financial growth.

Learn DeeperCreate a Budget and Stick to It: Begin by tracking your monthly income and expenses. Identify areas where you can cut back, such as dining out or subscription services, and allocate those savings towards investments or an emergency fund.

Invest in Yourself: Dedicate at least one hour each day to learning something new related to your field or to personal finance. This could be through books, online courses, or podcasts. Increasing your knowledge can lead to higher earning potential.

Automate Your Savings: Set up automatic transfers from your checking account to your savings or investment accounts. This ensures you consistently save a portion of your income without having to think about it.

Seek Additional Income Streams: Consider ways to earn extra income outside of your primary job. This could be through freelancing, starting a side business, or investing in income-generating assets like rental properties.

Regularly Review Your Financial Plan: At least once a quarter, review your financial goals and progress. Adjust your budget, savings, and investments as needed to stay on track towards building wealth.

- Example

Imagine you spend $5 every weekday on coffee. By brewing coffee at home and saving that money instead, you could allocate approximately $100 per month towards your investment portfolio.

- Example

If you're a graphic designer by profession, spending an hour each day learning web development could significantly increase your marketability and potential income, allowing you to take on more diverse projects or command higher rates.

Avoid Economic Outpatient Care to Encourage Independence and Wealth Accumulation

Providing substantial financial assistance to adult children or relatives can hinder their ability to become financially independent and may even impede your own wealth accumulation.

Instead, focus on teaching them financial literacy and self-reliance.

This encourages responsible money management and ensures that your wealth is preserved and grown, rather than depleted by ongoing financial support.

Learn DeeperSet Clear Financial Boundaries: Start by having an open conversation with your adult children or relatives about finances. Explain your intention to support them in becoming financially independent rather than providing ongoing financial assistance. Establish what you are willing to help with (e.g., education costs) and what you expect them to manage on their own (e.g., monthly rent or leisure expenses).

Encourage Financial Education: Offer resources or suggest courses on personal finance management. This could be as simple as recommending a book on budgeting or enrolling them in an online course about investing. The goal is to equip them with the knowledge to make informed financial decisions.

Promote Earning and Saving: Motivate them to earn their own money and save a portion of it. This could involve encouraging them to get a job, if they don’t already have one, or to look for better-paying opportunities. Discuss the importance of saving for emergencies, future goals, and retirement.

Lead by Example: Demonstrate responsible money management through your own actions. Share your budgeting techniques, how you save for goals, and make investment decisions. Seeing these practices in action can be incredibly influential.

- Example

If your adult child is struggling with credit card debt, instead of paying off the balance for them, offer to match their payments to double their impact. This encourages them to contribute and take responsibility while still providing support.

- Example

Create a family investment club where each member contributes a small amount monthly, and then collectively decide on investments. This not only teaches investment strategies but also promotes the idea of growing wealth together without relying on one person's financial support.

Invest in Appreciating Assets Rather Than Depreciating Liabilities

Wealthy individuals often invest in assets that appreciate in value over time, such as real estate, stocks, and bonds, rather than spending heavily on depreciating liabilities like luxury cars or the latest gadgets.

This approach focuses on building a portfolio of investments that can generate passive income and increase in value, contributing to long-term financial security and wealth accumulation.

Learn DeeperStart by evaluating your current spending habits. Identify areas where you might be investing in depreciating liabilities, such as high-end electronics that lose value quickly or expensive cars. Consider redirecting some of these funds towards appreciating assets.

Educate yourself on investment options. Spend time learning about the stock market, real estate investments, and bonds. There are numerous online courses and resources available that cater to beginners.

Open an investment account. If you don’t already have one, look into opening a brokerage account or a retirement account like an IRA or a 401(k), which can be a starting point for investing in stocks and bonds.

Consider real estate investments. This doesn’t necessarily mean buying a property outright; you could start with real estate investment trusts (REITs) which allow you to invest in real estate without owning physical property.

Automate your savings and investments. Set up automatic transfers from your checking account to your savings and investment accounts. This makes it easier to consistently invest in appreciating assets over time.

- Example

Instead of purchasing the latest $1,000 smartphone every year, consider putting that money into a diversified stock portfolio. Over time, this investment is likely to appreciate, providing a greater return on investment.

- Example

Rather than leasing a luxury car that loses value the moment you drive it off the lot, invest in a rental property. The rental income can provide a steady cash flow, and the property itself may increase in value, offering both immediate and long-term financial benefits.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Millionaire Next Door Summary: Common Questions

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh