I Will Teach You to Be Rich

No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

What's it about?

I Will Teach You to Be Rich offers an effective approach to personal finance and wealth building. This book guides you through a 6-week program focusing on four pillars: banking, saving, budgeting, and investing. Sethi simplifies complex financial concepts, showing you how to manage money effectively without giving up what you love. You'll learn about automating your finances, making smart investments, and negotiating your salary to maximize your wealth. Ideal for those looking to take control of their financial future without the jargon or fluff.

About the Author

Ramit Sethi is a personal finance advisor and author best known for his book "I Will Teach You To Be Rich." His approach combines psychology with practical financial advice, focusing on automation, investing, and strategic spending. Sethi's work emphasizes no-guilt finance, aiming to make wealth-building accessible and actionable.

10 Key Ideas of I Will Teach You to Be Rich

Automate Your Finances to Effortlessly Save and Invest

Setting up automatic transfers for your paycheck distribution into savings, investments, and bills ensures that you consistently save and invest without having to think about it each month.

This method leverages the 'out of sight, out of mind' principle, effectively helping you live within your means while also growing your wealth over time.

Automation reduces the temptation to overspend and makes financial growth nearly effortless.

Learn DeeperReview your monthly income and expenses to determine how much you can realistically save and invest each month. This will be the foundation of your automation plan.

Set up automatic transfers from your checking account to your savings and investment accounts, as well as automatic payments for your recurring bills. Choose dates right after your payday to ensure you have enough funds.

Monitor your accounts at least quarterly to adjust your savings and investment contributions as your financial situation changes or as you reach your goals.

Use online banking or financial management tools to easily set up and manage your automatic transfers and payments. Many banks offer features that allow you to categorize transactions and set goals.

Create a 'splurge' account where a small portion of your paycheck is automatically deposited for guilt-free spending. This helps satisfy your spending urges without derailing your financial goals.

- Example

If your monthly paycheck is $3,000, you might set up an automatic transfer of $600 (20%) to your savings account, $300 (10%) to your investment account, and allocate the rest to cover bills and living expenses.

- Example

Jane, a graphic designer, receives her bi-weekly paycheck and has set up her bank account to automatically transfer $200 to her emergency savings, $100 to her retirement account, and pay off her monthly credit card bill in full, two days after her salary is deposited.

Spend Consciously on What You Love, Cut Costs Mercilessly on What You Don't

Identify what truly brings you joy and allocate your spending accordingly, rather than adhering to generic budgeting advice.

Simultaneously, aggressively reduce expenses in areas that are not meaningful to you.

This approach maximizes personal satisfaction from your expenditures and ensures that your money is spent in alignment with your values and interests, leading to a more fulfilling financial life.

Learn DeeperTrack Your Spending for a Month: Start by keeping a detailed record of every penny you spend for at least one month. This will help you identify where your money is going and what brings you the most joy.

Categorize Your Expenses: Divide your expenses into categories such as 'Essentials', 'Joy', and 'Indifferent'. This will make it easier to see where you can cut back without sacrificing happiness.

Set Spending Goals Based on Your Values: Reflect on what makes you happiest and allocate a larger portion of your budget towards these areas. Conversely, set strict limits or eliminate spending on things that don't bring you joy or align with your values.

Automate Your Savings and Bills: Automate as much of your financial management as possible. This includes setting up automatic transfers to your savings account and automating bill payments. This ensures that you're saving consistently and avoiding late fees, allowing you to focus more on spending in areas that matter to you.

Regularly Review and Adjust Your Spending: Make it a habit to review your spending habits and budget allocations regularly. As your interests and values evolve, so should your spending. This ensures that your money continues to be spent in ways that enrich your life.

- Example

If you discover that dining out with friends twice a week brings you significant joy, you might decide to cut back on subscription services you rarely use in order to fund these gatherings.

- Example

After tracking your spending, you might find that you're indifferent to having a brand-new car but highly value traveling. You could then opt for a less expensive vehicle or delay upgrading your car to save for a major trip.

Invest Early and Often to Take Advantage of Compound Interest

Starting your investment journey as early as possible allows your money more time to grow through the power of compound interest.

Even small, regular investments can grow significantly over time, creating a substantial nest egg for the future.

This strategy emphasizes the importance of consistency and the long-term perspective in building wealth.

Learn DeeperStart with what you can afford: Even if it's just a small amount, begin investing now. Don't wait for a 'better' financial situation. Over time, these small investments add up.

Automate your investments: Set up automatic transfers from your checking account to your investment account. This ensures you invest consistently without having to think about it every month.

Increase your contributions over time: As your income grows, gradually increase the amount you invest. Even a 1% increase per year can make a significant difference in the long run.

Diversify your investments: Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate) to reduce risk and increase potential returns.

Reinvest your dividends: Instead of taking your dividends as cash, reinvest them. This compounds your investments further, accelerating your portfolio's growth.

- Example

If you start investing $100 a month at an average annual return of 7%, in 30 years, you could have over $121,000. Increase that to $200 a month, and you could have over $242,000.

- Example

Jane automates a monthly transfer of $150 from her checking account to her Roth IRA. Each year, she increases her contribution by $50. After 10 years, not only has she adjusted to the gradual increase without impacting her lifestyle significantly, but her investments have also grown substantially more than if she had stuck with the initial $150.

Negotiate Your Salary to Dramatically Increase Your Earning Potential

Your salary is your biggest wealth-building tool.

Learning how to negotiate effectively can lead to significant increases in your income.

These negotiations should be based on market research, your accomplishments, and your value to the company.

Increasing your salary has compounding effects over your career, potentially offering more opportunities for saving, investing, and spending on what matters most to you.

Learn DeeperResearch your market value: Use websites like Glassdoor, PayScale, and LinkedIn Salary to find out what others in your position and industry are earning. This information will be crucial in your negotiations.

Prepare your accomplishments: Document your achievements, projects you've led, and any additional responsibilities you've taken on. Quantify your results whenever possible, such as revenue generated or efficiency improvements.

Practice your pitch: Before the negotiation, practice what you're going to say. You can do this with a friend or mentor. Focus on how your work benefits the company and be ready to discuss your salary expectations confidently.

Schedule a meeting: Don't spring the conversation on your boss. Instead, schedule a specific time to discuss your performance and compensation. This shows professionalism and ensures you both have the time to engage in a meaningful discussion.

Be prepared for any outcome: While your goal is to get a raise, be prepared for any response. If a salary increase isn't possible now, ask what you can do to work towards one in the future or negotiate for other benefits like more vacation time or flexible working hours.

- Example

Example 1: Alex discovered through PayScale that the average salary for their role in the industry was 10% higher than what they were earning. They compiled a list of their contributions to recent projects, showing how their work increased company revenue by 15% over the past year. Alex practiced their negotiation pitch with a mentor, then scheduled a meeting with their manager, successfully negotiating a 12% salary increase.

- Example

Example 2: Jordan, after being turned down for a direct salary increase, negotiated to attend two professional development courses, paid for by the employer, aiming to enhance their skills in project management and data analysis. This not only added to Jordan's value as an employee but also positioned them better for a future salary negotiation.

Create a Conscious Spending Plan Instead of a Restrictive Budget

A conscious spending plan allows you to direct your money towards your goals and values, including savings, investments, and guilt-free spending on enjoyment.

Unlike traditional budgets that can feel restrictive and hard to stick to, this plan encourages a balanced approach to managing finances, focusing on intentional spending and saving.

Learn DeeperTrack Your Spending for a Month: Before you can create a conscious spending plan, you need to know where your money is currently going. Use an app or a simple spreadsheet to track every dollar you spend for one month. This will give you a clear picture of your spending habits.

Categorize Your Expenses and Income: After tracking your spending, categorize your expenses (e.g., rent, groceries, dining out, entertainment). Also, note all sources of income. This helps in understanding your financial flow and identifying areas where adjustments can be made.

Set Clear Financial Goals: Define what you want to achieve with your money in the short-term (next year), medium-term (next five years), and long-term (beyond five years). Goals could include saving for a vacation, buying a home, or investing for retirement.

Allocate Your Money According to Your Values and Goals: Based on your goals and spending analysis, allocate percentages of your income towards necessities, savings/investments, and wants. For example, a common allocation is the 50/30/20 rule—50% on needs, 30% on wants, and 20% on savings.

Automate Your Finances: Set up automatic transfers for your savings and bills. This ensures you save consistently and pay your bills on time without having to think about it every month.

Regularly Review and Adjust Your Plan: Your financial situation and goals may change, so it's important to review your conscious spending plan regularly (e.g., every six months) and adjust as necessary.

- Example

If after tracking your spending, you find that you're spending 40% of your income on dining out and entertainment but only saving 5%, you might decide to reallocate funds to increase your savings rate while still allocating a portion of your income towards dining and entertainment that allows you to enjoy life guilt-free.

- Example

Imagine you earn $3,000 a month. Following the 50/30/20 rule, you'd allocate $1,500 towards necessities like rent and groceries, $900 towards wants like dining out and hobbies, and $600 towards your savings or investment goals. This structured yet flexible approach allows for enjoyment while ensuring financial goals are met.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

I Will Teach You to Be Rich Summary: Common Questions

"I Will Teach You to Be Rich" by Ramit Sethi begins with an impactful quote, "What's the point of haggling over the price of a latte if you're losing $100 a month in bank fees?" This quote sets the tone for the entire book, emphasizing the importance of focusing on significant financial wins rather than getting caught up in minor expenses.

Sethi's book offers practical advice on automating finances, investing in low-cost index funds, and negotiating a higher salary. His approach is straightforward and actionable, making it easy for readers to implement the strategies outlined in the book. He also delves into the psychological aspects of money management, providing insights into our behavior around finances.

Overall, "I Will Teach You to Be Rich" is a must-read for anyone looking to take control of their finances and build wealth for the future. Readers who enjoyed books like "The Millionaire Next Door" or "Rich Dad Poor Dad" will find Sethi's advice both refreshing and empowering.

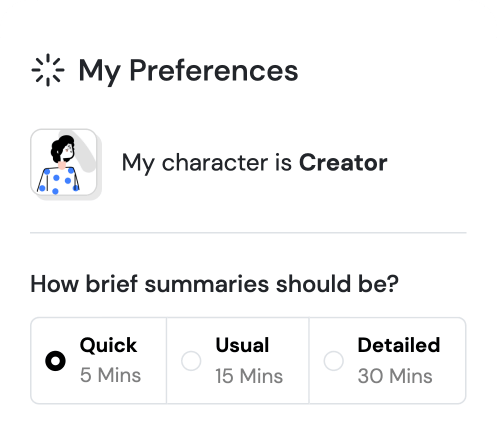

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh