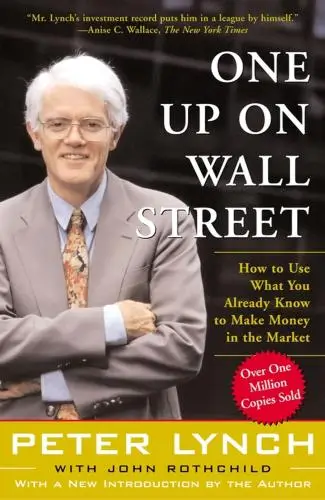

One Up On Wall Street

How To Use What You Already Know To Make Money In The Market

What's it about?

One Up On Wall Street by Peter Lynch is a must-read if you're aiming to excel in the stock market. Lynch, a renowned investment expert, shares his insightful strategies for picking winning stocks. He emphasizes that individual investors have a significant advantage over Wall Street professionals through everyday observations. The book breaks down complex financial concepts into understandable language, guiding you on how to use what you already know to make lucrative investment choices. It's not just about stocks; it's about recognizing opportunity in your daily life and turning it into investment success.

About the Author

Peter Lynch is a highly respected former mutual fund manager and author, best known for his investment strategy books including "One Up On Wall Street." His approach emphasizes investing in well-understood companies and the importance of 'invest in what you know,' blending keen market insights with accessible writing for investors at all levels.

10 Key Ideas of One Up On Wall Street

Invest in What You Know and Understand

Focusing on companies within your realm of knowledge or expertise gives you a competitive edge.

This approach allows you to make informed decisions based on firsthand experience or understanding of the industry.

It's easier to predict the success of a business when you're familiar with its products, services, and market dynamics.

Learn DeeperIdentify Your Areas of Expertise: Start by making a list of industries or sectors you're familiar with. This could be related to your job, hobbies, or areas you're naturally interested in. For example, if you're a teacher, you might know a lot about educational tech companies.

Research Companies Within Your Realm: Once you've identified your areas of expertise, look for companies within these sectors. Use tools like financial news websites, company reports, and industry forums to gather information.

Evaluate Product or Service Viability: Think about the products or services offered by these companies. Are they in demand? Do you see people using them in your daily life? This firsthand observation can be a powerful indicator of a company's potential success.

Stay Informed and Update Your Knowledge: Industries evolve, and staying updated on trends and changes is crucial. Subscribe to industry newsletters, follow relevant social media accounts, and participate in forums or discussions to keep your knowledge fresh.

Start Small and Diversify: When you're ready to invest, start small. Even if you're confident in your knowledge, it's wise to diversify your investments to mitigate risks. Invest in a few companies across different sectors you're familiar with.

- Example

If you're a tech enthusiast who loves gadgets, you might have noticed the rising popularity of smart home devices. Investing in companies that produce or develop smart home technology could be a strategic move based on your understanding of the market.

- Example

As a fitness instructor, you're likely familiar with the latest health and wellness trends. You might have observed the growing demand for plant-based protein supplements among your clients. This insight could guide you to invest in companies that are leading in the plant-based nutrition space.

Ignore Market Predictions and Focus on Company Fundamentals

Market predictions are often speculative and unreliable.

Instead, concentrate on a company's fundamentals such as earnings growth, debt levels, profit margins, and management quality.

Solid fundamentals are indicative of a company's potential for long-term success, regardless of short-term market fluctuations.

Learn DeeperStart by reviewing a company's financial statements: Look for consistent earnings growth over the past few years. This is a good indicator of a company's health and potential for future success.

Evaluate the company's debt levels: High levels of debt can be a red flag. Compare the company's debt to its equity to understand how much risk it's taking on.

Analyze profit margins: Higher profit margins can indicate a competitive advantage. Look at the company's operating and net profit margins to gauge its efficiency.

Research the management team: A strong, experienced management team can be a key driver of a company's success. Look into their track record and how they've navigated past challenges.

- Example

If you're considering investing in a tech company, you might start by looking at its revenue growth over the past five years, checking if it has been increasing steadily. Then, assess its debt-to-equity ratio to ensure it's not overly reliant on debt for growth. Next, compare its profit margins with competitors to see if it has a competitive edge. Finally, research the CEO and key executives to evaluate their experience and effectiveness.

- Example

For a retail company, begin by examining its same-store sales growth and overall revenue trends. This will give you an idea of its market position and growth potential. Assess its inventory turnover rate and debt levels to gauge operational efficiency and financial health. Investigate the profit margins to understand how well it manages costs relative to sales. Lastly, look into the management team's background, focusing on their experience in retail and their strategic vision for the company.

The Importance of Patience in Investing

Investing is not about getting rich quick but about earning steady returns over time.

Patience is key to seeing through temporary market downturns and allowing your investments to compound and grow.

Impulsive decisions can lead to missed opportunities and losses.

Learn DeeperStart with a long-term perspective: Before investing, define your long-term goals. Are you saving for retirement, a house, or your child's education? Knowing what you're investing for can help you stay the course during market fluctuations.

Create and stick to an investment plan: Develop a diversified investment strategy that aligns with your risk tolerance and financial goals. Regularly review and adjust your portfolio as needed, but avoid making hasty decisions based on short-term market movements.

Educate yourself about your investments: Take the time to understand the companies or funds you're investing in. Look for businesses with strong fundamentals and growth prospects. This knowledge will give you confidence in your investment choices, even when the market is volatile.

Practice regular investing: Consider setting up automatic contributions to your investment accounts. This strategy, known as dollar-cost averaging, helps you buy more shares when prices are low and fewer when prices are high, potentially lowering the average cost per share over time.

- Example

Imagine you've invested in a company that you believe has strong long-term growth prospects, but its stock price drops due to a temporary market downturn. Instead of selling in a panic, you remember your research and hold onto the stock, allowing it to recover and grow in value over the years.

- Example

You decide to start investing a fixed amount into a diversified mutual fund every month. Even when the market dips, you continue making these regular investments. Over time, this strategy pays off as the market recovers, and your consistent investments have bought more shares at lower prices, enhancing your overall returns.

Diversify Wisely to Manage Risk

While diversification is important to mitigate risk, over-diversification can dilute potential returns.

Aim for a balanced portfolio that spreads risk across different sectors and asset classes without holding so many investments that managing them becomes impractical or counterproductive.

Learn DeeperStart by assessing your current portfolio. Look at what you own and categorize each investment by sector and asset class. This will give you a clear picture of where you might be over or underexposed.

Set clear investment goals. Understand what you're trying to achieve with your investments, whether it's long-term growth, income, or preservation of capital. This will guide how you diversify.

Research before you diversify. Instead of adding stocks or assets randomly, choose ones that align with your investment goals and have solid fundamentals. Quality over quantity should be your mantra.

Regularly review and rebalance your portfolio. The market changes, and so will the composition of your portfolio. Make adjustments to ensure it stays aligned with your diversification strategy and investment goals.

Limit the number of holdings. Aim for a sweet spot that allows you to manage risk without diluting potential returns too much. A common recommendation is between 10 to 30 different investments, depending on your capacity to manage them.

- Example

If you're heavily invested in technology stocks, consider diversifying by adding investments in other sectors such as healthcare or consumer goods to spread your risk.

- Example

For someone with a portfolio of mostly U.S. stocks, adding international stocks or bonds can provide diversification benefits, as these may perform differently from U.S. markets over time.

Look for Stocks That Offer Both Value and Growth

Seek out undervalued stocks with strong growth potential.

These are companies whose stock prices don't fully reflect their future earnings prospects.

Investing in these 'growth at a reasonable price' (GARP) stocks can offer higher returns as the market corrects the undervaluation.

Learn DeeperStart by doing your homework: Research companies thoroughly before investing. Look into their financial health, market position, and growth potential. Use resources like financial news, company reports, and stock analysis platforms.

Learn to read financial statements: Focus on understanding a company's balance sheet, income statement, and cash flow statement. This will help you assess whether a stock is undervalued and has strong growth prospects.

Use valuation ratios wisely: Familiarize yourself with key valuation metrics such as Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Price-to-Sales (P/S) ratio. A lower ratio may indicate an undervalued stock, but always consider the industry average and the company's growth potential.

Keep an eye on industry trends and economic indicators: Industries often move in cycles, and being aware of these can help you spot growth opportunities. Economic indicators like GDP growth rates, unemployment rates, and consumer confidence can also provide clues about future earnings prospects.

Diversify your investments: While seeking out GARP stocks, don't put all your eggs in one basket. Diversifying your portfolio across different sectors and industries can reduce risk.

- Example

Imagine you're considering investing in a tech company that has recently developed a revolutionary product. Despite its potential, the stock is trading at a P/E ratio significantly lower than the industry average. After researching the company's financials and market potential, you conclude it's undervalued and decide to invest, anticipating growth as the market recognizes its value.

- Example

You notice a retail company that has consistently increased its revenue and expanded its online presence, yet its stock price has remained stagnant due to a temporary market downturn. Its P/E ratio is lower than competitors', suggesting it's undervalued. Believing in its growth potential, you invest, expecting the stock to rebound as the market recovers.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

One Up On Wall Street Summary: Common Questions

"Go for a business that any idiot can run - because sooner or later, any idiot probably is going to run it." This quote from Peter Lynch's One Up On Wall Street encapsulates the essence of his investment philosophy. Lynch, a successful mutual fund manager, emphasizes the importance of investing in what you know and understanding the companies you invest in.

Throughout the book, Lynch shares anecdotes and practical advice on how individual investors can leverage their everyday experiences to identify opportunities in the stock market. His down-to-earth approach and emphasis on long-term thinking make the concepts in the book accessible to readers of all levels of investment experience.

Overall, One Up On Wall Street is a must-read for anyone interested in learning about stock market investing. Lynch's wisdom, humor, and real-world examples make this book both educational and entertaining. It's a great starting point for beginners and a refreshing perspective for seasoned investors.

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh