Secrets of the Millionaire Mind

Mastering the Inner Game of Wealth

What's it about?

Secrets of the Millionaire Mind delves into the fundamental differences between how millionaires and the average person think about and manage money. It offers you practical insights and mental strategies to enhance your financial life by adjusting your mindset. Learn to identify and change your own financial blueprint, essentially reprogramming the way you think about wealth. This book equips you with tools to break through barriers and achieve success in the financial domain.

About the Author

T. Harv Eker is a motivational speaker and author best known for his book "Secrets of the Millionaire Mind," which explores the mindset and financial strategies of wealthy individuals. His work emphasizes personal development, wealth creation, and the psychological aspects of financial success.

10 Key Ideas of Secrets of the Millionaire Mind

Commit to Wealth

Wealth doesn't come from wishful thinking; it requires a firm commitment.

This means setting clear financial goals, creating actionable plans, and dedicating yourself to achieving them.

Commitment also involves persistence and resilience in the face of setbacks.

When you are truly committed, you will find ways to overcome obstacles and stay focused on your path to financial success.

This unwavering dedication separates those who achieve wealth from those who merely dream about it.

Learn DeeperSet Clear Financial Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. For example, aim to save $10,000 in a year or pay off a specific debt within six months.

Create an Actionable Plan: Break down your financial goals into smaller, manageable tasks. If your goal is to save $10,000 in a year, plan to save approximately $833 each month. Identify ways to cut expenses or increase income to meet this target.

Track Your Progress: Regularly monitor your financial progress. Use budgeting apps or spreadsheets to keep track of your income, expenses, and savings. Adjust your plan as needed to stay on track.

Stay Persistent and Resilient: Understand that setbacks are part of the journey. If you face unexpected expenses or financial challenges, reassess your plan and find alternative ways to stay committed to your goals. Maintain a positive mindset and keep pushing forward.

Educate Yourself: Continuously learn about personal finance, investing, and wealth-building strategies. Read books, attend seminars, or take online courses to enhance your financial knowledge and skills.

- Example

Jane sets a goal to save $5,000 for an emergency fund within a year. She creates a budget, identifies areas where she can cut back on spending, and sets up automatic transfers to her savings account each month. Despite facing an unexpected car repair, she adjusts her budget and continues to save diligently, reaching her goal by the end of the year.

- Example

Mark aims to pay off $20,000 in student loans within three years. He creates a detailed repayment plan, including extra payments from his side hustle. When he loses his job, he doesn't give up. Instead, he finds temporary work, reduces his expenses, and continues making loan payments, eventually achieving his goal.

Think Big and Act Boldly

To become wealthy, you need to think big and take bold actions.

Small thinking leads to small results, while expansive thinking opens up greater opportunities.

This involves stepping out of your comfort zone, taking calculated risks, and being willing to fail and learn from mistakes.

Bold actions might include starting a business, investing in new ventures, or pursuing high-impact projects.

By thinking big and acting boldly, you position yourself to achieve extraordinary financial success.

Learn DeeperSet Big Goals: Start by setting ambitious financial goals that push you beyond your current limits. Write them down and break them into smaller, manageable steps.

Step Out of Your Comfort Zone: Identify areas in your life where you feel comfortable but stagnant. Challenge yourself to take on new experiences that make you uncomfortable but have the potential for growth.

Take Calculated Risks: Evaluate opportunities that come your way and be willing to take risks after thorough research and planning. This could mean investing in stocks, real estate, or starting a side business.

Learn from Failures: Embrace failures as learning opportunities. Analyze what went wrong, adjust your strategy, and try again with improved tactics. Network with Like-Minded Individuals: Surround yourself with people who think big and act boldly. Join groups, attend seminars, or find a mentor who can inspire and guide you. Invest in Personal Development: Continuously seek knowledge and skills that can help you achieve your big goals. This could include reading books, taking courses, or attending workshops related to your field.

- Example

Starting a Business: Imagine you have a passion for fitness. Instead of just working out and sharing tips with friends, you decide to start a fitness coaching business. You create a business plan, invest in marketing, and start offering online and in-person training sessions. This bold move could lead to significant financial success if executed well.

- Example

Investing in Real Estate: You have some savings and instead of letting it sit in a low-interest savings account, you decide to invest in real estate. You research the market, find a promising property, and purchase it. Over time, you rent it out or sell it at a higher price, significantly increasing your wealth.

Focus on Opportunities, Not Obstacles

Successful people focus on opportunities rather than obstacles.

They see potential where others see problems and are always looking for ways to capitalize on favorable situations.

This positive outlook enables them to spot and seize opportunities that others might miss.

Cultivating an opportunity-focused mindset involves training yourself to look for the silver lining in every situation and being proactive in seeking out new ventures and investments.

Learn DeeperShift Your Perspective: Start by consciously reframing challenges as opportunities. When faced with a problem, ask yourself, 'What can I learn from this?' or 'How can this situation benefit me in the long run?'.

Set Opportunity Goals: Regularly set goals that focus on identifying and capitalizing on new opportunities. This could be in your career, personal life, or investments. Make it a habit to review these goals and track your progress.

Network Actively: Surround yourself with positive, opportunity-focused individuals. Attend networking events, join professional groups, and engage in conversations that inspire and motivate you to see potential where others see obstacles.

Stay Informed: Keep yourself updated with industry trends, market changes, and new technologies. Being well-informed allows you to spot opportunities early and act on them before others do.

Practice Gratitude: Cultivate a habit of gratitude to maintain a positive outlook. Each day, write down three things you are grateful for. This practice helps you focus on the positives and opens your mind to new possibilities.

- Example

Imagine you are at work and a major project falls through. Instead of dwelling on the failure, you could use this as an opportunity to analyze what went wrong, learn from the mistakes, and propose a new, innovative project that addresses the gaps identified.

- Example

Suppose you are interested in investing but the market seems volatile. Rather than seeing this as a deterrent, you could view it as a chance to research and invest in undervalued stocks or emerging markets that have the potential for high returns once stability resumes.

Develop a Wealthy Mindset

A wealthy mindset encompasses attitudes and habits that promote financial success.

This includes valuing your time, prioritizing financial education, and surrounding yourself with successful people.

It also means adopting a long-term perspective, being disciplined with money management, and continuously seeking growth and improvement.

By cultivating a wealthy mindset, you align your thoughts and behaviors with the principles that lead to financial abundance.

Learn DeeperValue Your Time: Treat your time as a precious resource. Prioritize tasks that contribute to your financial goals and delegate or eliminate those that don't.

Prioritize Financial Education: Dedicate time each week to learning about personal finance, investing, and money management. Read books, take online courses, or listen to financial podcasts.

Surround Yourself with Successful People: Network with individuals who have achieved financial success. Join professional groups, attend seminars, or find a mentor who can provide guidance and inspiration.

Adopt a Long-Term Perspective: Focus on long-term financial goals rather than short-term gains. Create a financial plan that includes saving, investing, and planning for future expenses.

Be Disciplined with Money Management: Create a budget and stick to it. Track your spending, save a portion of your income, and avoid unnecessary debt.

Seek Continuous Growth and Improvement: Regularly assess your financial situation and look for ways to improve. Set new financial goals, learn new skills, and stay updated on financial trends.

- Example

Imagine you have a goal to save for a down payment on a house. You start by creating a detailed budget, cutting unnecessary expenses, and setting up automatic transfers to a savings account. You also spend time each week learning about real estate markets and mortgage options to make informed decisions when the time comes.

- Example

Suppose you want to invest in the stock market. You begin by reading books on investing, attending webinars, and joining an investment club. You connect with experienced investors who share their strategies and insights, helping you build a diversified portfolio that aligns with your long-term financial goals.

Manage Your Money Wisely

Effective money management is crucial for building and maintaining wealth.

This involves budgeting, saving, investing, and minimizing unnecessary expenses.

Create a financial plan that allocates funds for different purposes, such as living expenses, savings, investments, and charitable giving.

Regularly review and adjust your plan to ensure it aligns with your financial goals.

Wise money management helps you grow your wealth steadily and sustainably over time.

Learn DeeperCreate a Budget: Start by listing all your income sources and expenses. Categorize your expenses into essentials (like rent, utilities, groceries) and non-essentials (like dining out, entertainment). This will help you see where your money is going and identify areas where you can cut back.

Set Savings Goals: Determine specific amounts you want to save each month. This could be for an emergency fund, a vacation, or a down payment on a house. Automate your savings by setting up automatic transfers from your checking account to your savings account.

Invest Wisely: Research different investment options such as stocks, bonds, mutual funds, or real estate. Consider consulting with a financial advisor to create an investment strategy that aligns with your risk tolerance and financial goals.

Minimize Unnecessary Expenses: Review your spending habits and identify areas where you can reduce costs. This might include canceling unused subscriptions, cooking at home more often, or finding cheaper alternatives for certain products or services.

Regularly Review Your Financial Plan: Set aside time each month to review your budget, savings, and investments. Adjust your plan as needed to ensure it continues to align with your financial goals and any changes in your income or expenses.

- Example

Imagine you earn $3,000 per month. You create a budget and find that your essential expenses total $2,000. You decide to allocate $500 for savings and $300 for investments, leaving $200 for discretionary spending. By sticking to this plan, you steadily build your savings and investment portfolio over time.

- Example

Suppose you have a habit of buying coffee every morning, costing you $5 each day. By making coffee at home, you could save around $150 per month. You decide to redirect this saved money into a high-yield savings account, contributing to your emergency fund.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

Secrets of the Millionaire Mind Summary: Common Questions

"Rich people believe 'I create my life.' Poor people believe 'Life happens to me.'" This quote from Secrets of the Millionaire Mind sets the tone for T. Harv Eker's exploration of the mindset and beliefs that separate the wealthy from the rest. Eker delves into the idea that our financial success is deeply rooted in our thoughts and offers practical advice on how to rewire our thinking for abundance.

The book delves into the concept of our "money blueprint" and how our upbringing and experiences shape our relationship with money. Eker provides exercises and strategies to help readers identify and challenge their limiting beliefs around wealth. Although some ideas might seem a bit simplistic or controversial, the emphasis on taking control of one's mindset is an empowering message that resonates throughout the book.

If you're looking for a motivational read that challenges you to examine your beliefs around money and success, Secrets of the Millionaire Mind is a thought-provoking choice that offers practical steps for personal growth and financial abundance.

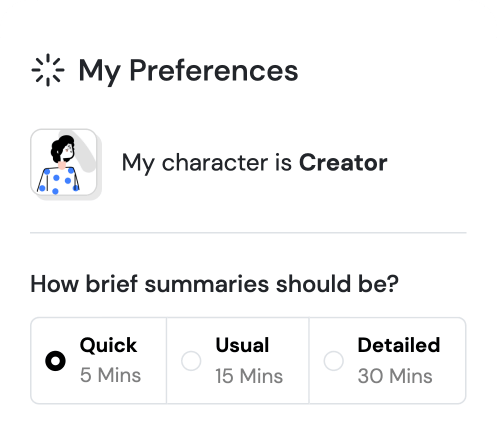

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh