The Automatic Millionaire

A Powerful One-Step Plan to Live and Finish Rich

What's it about?

The Automatic Millionaire offers a practical approach to building wealth over time without the need for a budget or strong willpower. You'll learn how to automate your finances, from paying yourself first to investing and paying off your home early, making financial success achievable no matter your income. Bach's strategies focus on long-term growth, emphasizing how small, consistent investments can lead to significant wealth. Discover the power of automating your financial life to effortlessly achieve your financial goals.

About the Author

David Bach is a financial author and expert known for his practical approach to personal finance and wealth-building. His notable works include "The Automatic Millionaire" and "Smart Women Finish Rich," emphasizing the power of automatic saving and investing. Bach's writing is accessible, focusing on actionable steps to achieve financial independence.

10 Key Ideas of The Automatic Millionaire

Pay Yourself First: The Key to Building Wealth

Prioritize saving a portion of your income before spending on anything else.

Automatically transfer a fixed percentage of your paycheck into a savings or investment account.

This ensures consistent growth of your wealth over time, leveraging the power of compound interest.

Learn DeeperSet Up Automatic Transfers: Arrange with your bank or employer to automatically transfer a fixed percentage of your paycheck into a savings or investment account each payday. This ensures you save before you have a chance to spend the money.

Determine Your Savings Percentage: Decide on a realistic percentage of your income to save. Start with at least 10% if possible, and adjust as needed based on your financial situation.

Create a Budget: Outline your monthly expenses and income to understand where your money is going. This will help you identify areas where you can cut back to increase your savings rate.

Use High-Interest Accounts: Place your savings in high-interest savings accounts or investment accounts to maximize the benefits of compound interest over time.

Review and Adjust Regularly: Periodically review your savings plan and adjust the percentage as your income changes or as you reach new financial goals.

- Example

Jane earns $3,000 per month. She sets up an automatic transfer of 10% ($300) from her paycheck to a high-interest savings account. Over time, this consistent saving habit helps her build a substantial emergency fund and invest for her future.

- Example

Mark decides to save 15% of his monthly income. He creates a budget to track his spending and identifies that he can cut back on dining out. He sets up an automatic transfer of $450 from his $3,000 monthly paycheck into a retirement investment account, leveraging compound interest to grow his wealth.

Automate Your Finances for Stress-Free Savings

Set up automatic transfers and payments for bills, savings, and investments.

Automation removes the temptation to spend money that should be saved and ensures you never miss a payment, avoiding late fees and building a strong financial foundation effortlessly.

Learn DeeperSet Up Automatic Transfers: Schedule a portion of your paycheck to be automatically transferred to a savings account or investment account each month. This ensures consistent saving without having to think about it.

Automate Bill Payments: Use your bank’s online bill pay service to set up automatic payments for recurring bills like utilities, rent, and credit cards. This helps avoid late fees and keeps your credit score healthy.

Use Financial Apps: Leverage financial apps that offer automation features. Apps like Mint, YNAB (You Need A Budget), or Acorns can help you track spending, save money, and invest effortlessly.

Create a Budget with Automation in Mind: When planning your budget, allocate funds for savings and investments first, then automate these transfers. This way, you prioritize your financial goals before discretionary spending.

- Example

Imagine you receive a paycheck on the 1st and 15th of every month. You can set up an automatic transfer of $200 from your checking account to your savings account on the 2nd and 16th of each month. This way, you save $400 monthly without even thinking about it.

- Example

Suppose you have a credit card bill due on the 20th of each month. By setting up an automatic payment through your bank to pay the minimum amount due on the 18th, you ensure you never miss a payment and avoid late fees, while also protecting your credit score.

The Latte Factor: Small Expenses Add Up

Identify and eliminate small, unnecessary daily expenses like coffee shop visits or dining out.

Redirect these funds into savings or investments.

Over time, these small amounts can accumulate significantly, contributing to your financial goals without major lifestyle changes.

Learn DeeperTrack Your Daily Spending: Start by keeping a daily log of all your expenses for a week or a month. This will help you identify where your money is going and highlight small, unnecessary expenses.

Set a Budget for Discretionary Spending: Allocate a specific amount for non-essential items like coffee, snacks, or dining out. Stick to this budget to avoid overspending on these small expenses.

Automate Your Savings: Set up an automatic transfer from your checking account to a savings or investment account. Even small amounts, like $5 or $10 a day, can add up over time.

Make Coffee at Home: Instead of buying coffee from a shop every day, invest in a good coffee maker and make your own. This can save you a significant amount of money over the year.

Pack Your Lunch: Prepare your meals at home and bring them to work instead of eating out. This not only saves money but can also be healthier.

- Example

If you spend $5 on coffee every weekday, that's $25 a week. Over a year, this adds up to $1,300. By making coffee at home, you could redirect that $1,300 into a savings account or investment fund.

- Example

Imagine you dine out for lunch every workday, spending around $10 each time. That's $50 a week, or $2,600 a year. By packing your lunch, you could save that $2,600 and use it to pay off debt, build an emergency fund, or invest.

Own Your Home: A Path to Financial Security

Invest in homeownership rather than renting.

Owning a home builds equity and provides long-term financial stability.

Make extra mortgage payments when possible to pay off your loan faster and save on interest, accelerating your path to financial independence.

Learn DeeperStart Saving for a Down Payment: Begin setting aside a portion of your income each month specifically for a down payment on a home. This can be done through automatic transfers to a dedicated savings account.

Research Mortgage Options: Look into different types of mortgages and interest rates. Consider consulting with a financial advisor to find the best mortgage plan that suits your financial situation.

Make Extra Mortgage Payments: Whenever possible, make additional payments towards your mortgage principal. This can significantly reduce the total interest paid over the life of the loan and shorten the repayment period.

Budget for Homeownership Costs: Factor in all costs associated with owning a home, including property taxes, maintenance, and insurance. Create a budget that accommodates these expenses without straining your finances.

Consider Refinancing: If interest rates drop or your credit score improves, look into refinancing your mortgage to secure a lower interest rate, which can save you money over time.

- Example

Jane, a 28-year-old professional, sets up an automatic transfer of $500 from her paycheck to a high-yield savings account every month. After three years, she has enough saved for a down payment on a modest home.

- Example

Mark and Lisa, a young couple, decide to make an extra mortgage payment of $200 each month. By doing this, they manage to pay off their 30-year mortgage in just 25 years, saving thousands of dollars in interest.

Create an Emergency Fund: Prepare for the Unexpected

Establish a dedicated emergency fund with three to six months' worth of living expenses.

This fund acts as a financial safety net, protecting you from unexpected events like job loss or medical emergencies.

It also prevents you from going into debt during tough times.

Learn DeeperAssess Your Monthly Expenses: Calculate your average monthly living expenses, including rent/mortgage, utilities, groceries, transportation, and any other essential costs.

Set a Savings Goal: Based on your monthly expenses, determine the total amount you need to save for three to six months of living expenses. This will be your emergency fund target.

Open a Separate Savings Account: Create a dedicated savings account specifically for your emergency fund. This helps keep the money separate from your regular spending and reduces the temptation to use it for non-emergencies.

Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund savings account. Decide on a fixed amount to transfer each month or each paycheck to ensure consistent progress towards your goal.

Cut Unnecessary Expenses: Review your budget and identify areas where you can cut back on non-essential spending. Redirect these savings into your emergency fund to reach your goal faster.

Increase Income: Look for opportunities to increase your income, such as taking on a side job, freelancing, or selling unused items. Use this extra income to boost your emergency fund.

- Example

Jane calculates her monthly expenses to be $2,500. She sets a goal to save $7,500 (three months' worth of expenses) in her emergency fund. She opens a new savings account and sets up an automatic transfer of $300 from her checking account to her emergency fund every month. Additionally, she cuts back on dining out and redirects that money into her savings.

- Example

Tom realizes he needs $18,000 to cover six months of his living expenses. He opens a separate savings account and starts transferring $500 from each paycheck into this account. To speed up the process, he takes on freelance projects and sells some old electronics, adding the extra income directly to his emergency fund.

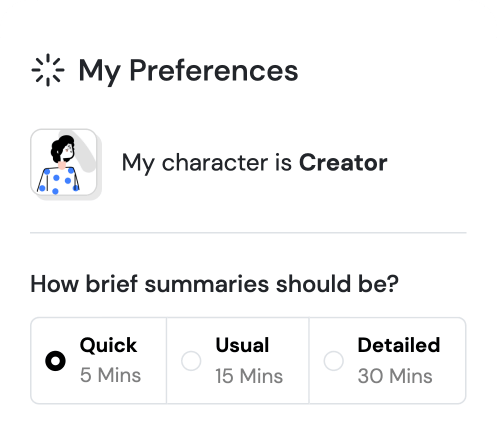

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Automatic Millionaire Summary: Common Questions

"The Latte Factor shows that if you change nothing about your daily purchase of a latte, and instead you invest that money, you can become a millionaire in the long run."

I just finished reading "The Automatic Millionaire," and it really opened my eyes to the power of automating finances. The concept of paying yourself first and setting up automatic contributions to saving and investing accounts was something that resonated with me. The book simplifies personal finance and emphasizes the importance of small, consistent actions over time to build wealth effortlessly.

While some parts felt a bit repetitive, the overall message of making smart financial choices consistently stuck with me. If you're looking for a practical and straightforward guide to building wealth over time, I would definitely recommend giving "The Automatic Millionaire" a read.

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh