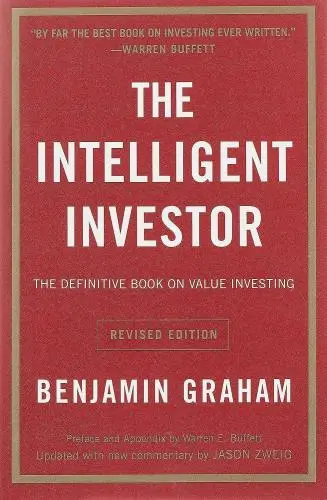

The Intelligent Investor

The Definitive Book on Value Investing

What's it about?

The Intelligent Investor is a cornerstone of investment literature, revered for introducing the principles of value investing. Graham's wisdom emphasizes long-term strategies, risk management, and the importance of psychological discipline. This guide equips both novices and seasoned investors with the tools to achieve financial success by focusing on fundamentals and intrinsic value rather than market trends. A must-read for anyone looking to navigate the complexities of the investment world with a steady hand.

About the Author

Benjamin Graham, often referred to as the father of value investing, authored influential works such as "The Intelligent Investor" and "Security Analysis." His investment philosophy emphasizes fundamental analysis, margin of safety, and a disciplined approach, significantly impacting the field of finance and guiding generations of investors.

10 Key Ideas of The Intelligent Investor

The Principle of Investing with a Margin of Safety

Investing with a margin of safety involves purchasing securities at prices significantly below their intrinsic value.

This approach minimizes the risk of loss by providing a buffer against errors in calculation or market volatility.

The concept emphasizes the importance of ensuring that even if estimations about the company's future earnings or assets are slightly off, the investment still remains sound due to the initial undervaluation.

This tactic not only protects against downside risk but also enhances potential returns as the market corrects the undervaluation.

Learn DeeperStart by learning how to calculate intrinsic value: Familiarize yourself with the basics of financial analysis. This includes understanding a company's balance sheet, income statement, and cash flow statement. There are plenty of online resources and courses that can guide you through this process.

Create a watchlist of undervalued stocks: Use financial news websites, stock screeners, and investment research platforms to identify stocks that are trading below their intrinsic value. Look for companies with strong fundamentals but whose stock prices have been beaten down due to temporary setbacks or market overreactions.

Set a purchase price with a margin of safety: Once you've identified a potentially undervalued stock, determine a purchase price that offers a significant margin of safety. This could be, for example, 20% to 30% below your calculated intrinsic value. This buffer will protect you against losses if your analysis is off or if the market remains irrational longer than you can stay solvent.

Regularly review and adjust your portfolio: Markets and company fundamentals change. Make it a habit to periodically review the stocks in your portfolio to ensure they still offer a margin of safety. Be prepared to sell stocks that no longer meet your criteria or to buy more of those that have become even more undervalued.

- Example

Imagine you've analyzed a company, ABC Corp, and determined its intrinsic value to be $100 per share. However, due to a recent scandal that you believe is temporary and won't affect long-term earnings, the stock has dropped to $70 per share. Buying at this price would give you a 30% margin of safety, cushioning against further drops and potential errors in your valuation.

- Example

You find XYZ Ltd., a company with solid fundamentals and a strong competitive advantage, but its stock has fallen 25% after missing earnings estimates by a small margin. After your analysis, you believe the intrinsic value of the stock to be $50 per share, but it's currently trading at $30. This gives you a significant margin of safety and an opportunity for substantial gains as the market corrects its overreaction.

The Importance of Distinguishing Between Investment and Speculation

Understanding the difference between investing and speculating is crucial for financial success.

Investing involves analyzing the fundamentals of a business, including its earnings, assets, and management, to make informed decisions with a long-term perspective.

In contrast, speculation is based on attempting to predict market movements and often involves higher risk.

By focusing on investment rather than speculation, individuals can make more rational, less emotionally driven decisions that are more likely to result in sustainable gains over time.

Learn DeeperStart with the Basics: Before making any investment, take the time to understand the fundamentals of the company you're interested in. Look into its earnings reports, balance sheet, and cash flow statements. This will give you a solid foundation to assess its long-term potential.

Set Clear Investment Goals: Define what you're aiming to achieve with your investments. Are you looking for steady income, long-term growth, or perhaps a combination of both? Having clear goals will help guide your investment decisions and keep you focused on the long-term.

Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes. This can help reduce risk and smooth out the volatility in your investment returns over time.

Avoid Emotional Decisions: It's easy to get caught up in the hype of a hot stock or panic in a market downturn. Make a conscious effort to base your investment decisions on rational analysis rather than emotions or market speculation.

Stay Informed and Patient: Keep up with financial news and trends, but remember that investing is a marathon, not a sprint. Patience is key. Avoid making hasty decisions based on short-term market movements.

- Example

If you're considering investing in a tech company, start by analyzing its annual and quarterly reports. Look at its revenue growth, profit margins, and debt levels. This will help you understand if the company has a solid foundation for long-term growth.

- Example

Imagine you've inherited a sum of money and decide to invest it. Instead of putting it all into the latest trending stock, you choose to spread it across a mix of stocks, bonds, and real estate investments. This diversification helps protect your portfolio from significant losses if one investment performs poorly.

Adopting a Defensive Investor Strategy for Stability and Growth

A defensive investor strategy focuses on minimizing risks and achieving steady returns.

This involves diversifying across different asset classes, investing in high-quality bonds and blue-chip stocks, and avoiding investments in speculative assets.

By prioritizing safety and adequate performance, defensive investors can protect their capital while still participating in the growth of the market.

This approach is particularly suitable for those with limited time or expertise to dedicate to investment analysis.

Learn DeeperStart with a solid foundation of high-quality bonds and blue-chip stocks. Allocate a significant portion of your investment portfolio to these assets. For bonds, consider those with high credit ratings (AAA to AA). For stocks, look for companies with a long history of profitability and dividend payments.

Diversify your investments across different asset classes. Don't put all your eggs in one basket. Include a mix of stocks, bonds, and possibly some real estate or commodities in your portfolio. This helps reduce risk because when one asset class is down, another might be up.

Avoid speculative investments. Stay away from assets with high volatility or those that promise high returns with unclear risk profiles. This includes avoiding investing in companies without a solid track record or those in highly volatile sectors without doing thorough research.

Regularly review and rebalance your portfolio. At least once a year, check if your investment allocations still align with your goals and risk tolerance. If necessary, sell some investments and buy others to maintain your desired asset allocation.

- Example

If you're starting with $10,000, you might decide to invest $4,000 in high-quality bonds, $5,000 in a mix of blue-chip stocks, and the remaining $1,000 in a diversified fund that includes real estate or commodities.

- Example

Imagine you've invested in a portfolio that's 70% stocks and 30% bonds. After a year of good stock market performance, your portfolio shifts to 80% stocks and 20% bonds. To rebalance, you might sell some stocks and buy more bonds to return to your original allocation.

The Role of Mr. Market in Making Rational Investment Decisions

Mr. Market is a metaphorical figure representing the stock market's mood swings, which can lead to irrational price fluctuations.

Investors should view Mr. Market as offering buying or selling opportunities rather than dictating the true value of securities.

When Mr. Market is pessimistic, it may present opportunities to buy quality stocks at discounted prices.

Conversely, when overly optimistic, it might be a signal to sell overvalued stocks.

The key is to remain rational and not be swayed by market sentiment.

Learn DeeperKeep a watchlist of quality stocks: Regularly update a list of companies you've researched and believe have strong fundamentals. When Mr. Market offers these at a discount, you're ready to act.

Set price targets: For each stock on your watchlist, determine a buy price based on its intrinsic value. This helps you make rational decisions when prices fluctuate.

Maintain an investment journal: Document your thoughts on market trends, specific stocks, and your emotional state. Reviewing this can help you identify if you're being swayed by Mr. Market's mood swings.

Diversify your portfolio: Don't put all your eggs in one basket. Having a mix of investments can protect you from the volatility Mr. Market might bring to a particular sector or stock.

Practice patience and discipline: Avoid making impulsive decisions based on daily market movements. Stick to your investment strategy and review it periodically to ensure it aligns with your financial goals.

- Example

Imagine you've been eyeing a tech company with strong growth potential, but its stock always seemed a bit pricey. One day, due to a market overreaction to a minor negative news event, the stock price drops significantly. Remembering Mr. Market's mood swings, you recognize this as a buying opportunity for a quality stock at a discount, rather than a sign of doom.

- Example

During a market rally, you notice that the stock of a solid company you own has exceeded your sell price target, reaching a valuation that no longer justifies its fundamentals. Recalling the lesson of Mr. Market's overoptimism, you decide to sell your shares and lock in the profits, rather than getting greedy and holding on for potentially unsustainable gains.

Emphasizing the Significance of Financial Statements in Investment Analysis

Analyzing a company's financial statements is fundamental to understanding its health and potential for future growth.

This includes examining the balance sheet, income statement, and cash flow statement to assess profitability, debt levels, and liquidity.

By doing so, investors can identify companies with strong fundamentals that are likely to provide stable returns over time.

This methodical approach helps in making informed decisions rather than relying on market rumors or trends.

Learn DeeperStart with the Basics: Before diving into complex analysis, ensure you understand the fundamental components of financial statements. The balance sheet shows a company's assets, liabilities, and shareholders' equity at a specific point in time. The income statement reveals the company's revenues, expenses, and profits over a period. The cash flow statement provides insight into the cash generated and used by the company in its operations, investments, and financing activities.

Look for Trends: Analyze the financial statements over multiple periods to identify trends. Are revenues growing? Is the company becoming more profitable? Are debt levels manageable? Consistent improvement in these areas can be a good indicator of a company's health and potential for future growth.

Calculate Key Ratios: Use financial ratios to assess the company's performance and financial health more effectively. Ratios such as the debt-to-equity ratio, current ratio, return on equity, and profit margin can provide valuable insights into the company's operational efficiency, liquidity, profitability, and risk.

Compare with Industry Peers: It's not enough to look at a company in isolation. Compare its financial metrics and ratios with those of its peers in the same industry. This will help you understand if the company is performing better or worse than its competitors, providing a clearer picture of its investment potential.

Stay Informed and Update Your Analysis Regularly: The financial health of a company can change. New quarterly reports, changes in the industry, or broader economic shifts can all impact a company's prospects. Regularly updating your analysis will help you stay informed and make better investment decisions over time.

- Example

Imagine you're considering investing in Company A. You start by looking at its balance sheet and notice that its cash reserves have been steadily increasing over the past three years, while its debt levels have decreased. This indicates a strong liquidity position and reduced financial risk.

- Example

While analyzing the income statement of Company B, you observe that its net income has grown by 10% annually for the last five years, outpacing the growth of its industry peers, which average around 6%. This suggests that Company B is not only profitable but also more efficient than its competitors, making it a potentially attractive investment.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Intelligent Investor Summary: Common Questions

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh