The Money Book for the Young, Fabulous & Broke

What's it about?

The Money Book for the Young, Fabulous & Broke addresses real-world financial challenges like student loans, credit card debt, and the quest for a first home. You'll learn smart strategies for budgeting, investing, and building a strong financial foundation. Ideal for those in their 20s and 30s, this book dispels myths and delivers clear, actionable advice to help you navigate your financial journey with confidence.

About the Author

Suze Orman is an American financial advisor, author, and podcast host known for her practical and empathetic approach to personal finance. Her work emphasizes self-empowerment and financial literacy, covering topics like debt management, investment, and retirement planning. Orman's notable books include "The 9 Steps to Financial Freedom" and "Women & Money."

10 Key Ideas of The Money Book for the Young, Fabulous & Broke

Embrace Your Financial Reality and Create a Budget That Reflects It

Understanding your current financial situation is the first step towards financial health.

This involves creating a detailed budget that accounts for all your income, expenses, debts, and savings.

By doing so, you can identify areas where you can cut back, how much you can afford to save, and strategies for paying down debt.

A realistic budget helps you live within your means while working towards your financial goals.

Learn DeeperTrack Your Spending for a Month: Keep a detailed record of every penny you spend for at least one month. This will give you a clear picture of where your money is going and help identify areas for potential savings.

Categorize Your Expenses: Divide your expenses into categories such as rent/mortgage, utilities, groceries, entertainment, and savings. This will help you see which areas are consuming most of your income and where you might adjust.

Set Realistic Savings Goals: Based on your budget, determine a realistic amount you can save each month. Even a small amount is a good start. Consider setting up an automatic transfer to your savings account to ensure you stick to your goal.

Prioritize Your Debts: Make a list of all your debts, including the interest rates. Focus on paying off high-interest debts first while maintaining minimum payments on others. This strategy reduces the amount of interest paid over time.

Review and Adjust Regularly: Your financial situation can change, so it's important to review and adjust your budget regularly. This might mean cutting back further in some areas or possibly finding ways to increase your income.

- Example

If after tracking your spending, you find that dining out is costing you $300 a month, consider reducing this by half and allocating the savings towards paying off a credit card debt.

- Example

After categorizing your expenses, you might discover that your monthly subscriptions (streaming services, magazines, etc.) total $100. Evaluate which services you actually use and cancel the rest, redirecting those funds into your savings account.

The Importance of Building a Good Credit Score Early On

A good credit score is crucial for financial independence.

It affects your ability to rent an apartment, buy a car, or secure a mortgage.

Start by getting a credit card, using it responsibly, and paying off the balance in full each month.

Regular, on-time payments and keeping your credit utilization low are key strategies for building and maintaining a strong credit score.

Learn DeeperApply for a starter credit card or a secured credit card if you're new to credit. Look for options that have low fees and report to all three major credit bureaus.

Set up automatic payments for at least the minimum amount due on your credit card to ensure you never miss a payment. Over time, aim to pay off the full balance each month to avoid interest charges.

Keep your credit utilization ratio under 30%. This means if you have a credit limit of $1,000, try not to carry a balance greater than $300. This shows lenders you're not overly reliant on credit.

Regularly check your credit report for errors or fraudulent activity. You're entitled to one free report from each of the three major credit bureaus every year through AnnualCreditReport.com.

Gradually diversify your credit by adding different types of credit accounts as you become more financially stable, such as a car loan or a student loan, but only if necessary and can afford it.

- Example

If you have a credit card with a $2,000 limit, aim to spend no more than $600 (30% utilization) and pay it off in full each month to both stay within the recommended credit utilization ratio and avoid paying interest.

- Example

Consider setting up a small, recurring payment on your credit card, like a monthly streaming service subscription. Then, set up an automatic payment from your bank account to your credit card to cover the charge each month. This strategy helps build a history of on-time payments without the risk of overspending.

Emergency Funds: Why You Need One and How to Start It

An emergency fund is essential for financial security, acting as a buffer against unexpected expenses such as medical bills, car repairs, or job loss.

Aim to save at least three to six months' worth of living expenses.

Start small if necessary and build up gradually.

This fund should be easily accessible, but separate from your regular checking account to avoid temptation.

Learn DeeperAutomate your savings: Set up a direct deposit from your paycheck into a dedicated emergency fund account. Even a small amount, like $50 per paycheck, can add up over time.

Cut back on non-essential expenses: Review your monthly spending and identify areas where you can cut back, such as dining out, subscription services, or impulse purchases. Redirect these savings to your emergency fund.

Sell unused items: Look around your home for items you no longer use or need. Selling these items can provide a quick boost to your emergency fund.

Set a monthly savings goal: Determine a realistic amount you can save each month and treat it as a non-negotiable expense. Adjust your budget accordingly to meet this goal.

Review and adjust regularly: Life changes, and so will your financial situation. Make it a habit to review your emergency fund every few months and adjust your contributions as needed.

- Example

If you receive a tax refund or a bonus at work, resist the temptation to spend it and instead deposit it directly into your emergency fund.

- Example

Create a separate savings account labeled 'Emergency Fund' to psychologically deter you from dipping into it for non-emergencies. Use an online bank that offers higher interest rates but still provides easy access when you need it.

Navigating Student Loans: Strategies for Management and Repayment

Student loans are a significant burden for many young adults.

Understand your loan terms, explore repayment options, and consider consolidation or refinancing if it lowers your interest rate or monthly payment.

Enroll in automatic payments to avoid late fees and consider making extra payments when possible to reduce the principal faster.

Learn DeeperReview your student loan agreement to fully understand the terms, interest rates, and repayment schedule. This foundational step ensures you know what you're dealing with.

Explore repayment options that might be available to you, such as income-driven repayment plans, which can adjust your monthly payments based on your income, making them more manageable.

Consider consolidating or refinancing your student loans if you have multiple loans or high-interest rates. This can simplify your payments and potentially lower your interest rate, but be sure to weigh the pros and cons, especially if considering federal loan consolidation versus private refinancing.

Set up automatic payments for your student loans to avoid missing payments and incurring late fees. Many lenders offer a slight interest rate reduction as an incentive for enrolling in auto-pay.

Make extra payments whenever possible, targeting the loan with the highest interest rate first (the avalanche method) or the smallest balance (the snowball method), depending on your financial strategy. Even small additional amounts can significantly reduce the principal over time.

- Example

If you have a student loan with a 6% interest rate and you're able to refinance it to a 4% rate through a reputable lender, you could save thousands of dollars in interest over the life of the loan.

- Example

Imagine you receive a $1,000 bonus at work. Instead of spending it immediately, you decide to make an extra payment on your student loan with the highest interest rate. This not only reduces the principal amount but also decreases the total interest you'll pay over time.

Investing 101: Starting Early Even with Small Amounts

The power of compound interest means starting to invest early can significantly impact your financial future, even if you start with small amounts.

Explore options like employer-sponsored retirement plans, IRAs, and low-cost index funds.

Focus on long-term growth, and don’t let short-term market fluctuations deter you from your investment goals.

Learn DeeperStart with what you can afford: Even if it's just a small amount, begin investing now. Look into setting up automatic contributions to a retirement account or an investment fund to make the process easier.

Take advantage of employer-sponsored plans: If your employer offers a 401(k) or similar retirement plan, especially with a match, make sure you're contributing enough to get the full match. It's essentially free money for your future.

Open an IRA: Consider opening an Individual Retirement Account (IRA) to start saving and investing for your future. There are options like Traditional or Roth IRAs, each with its own tax advantages.

Invest in low-cost index funds: These funds are a great way to diversify your investments and minimize fees. They track a specific market index, like the S&P 500, and have historically provided solid returns over the long term.

Stay the course: Don't panic during market downturns. Investing is for the long haul. Remember, it's about time in the market, not timing the market.

- Example

If your employer offers a 401(k) plan with a 3% salary match, by contributing at least 3% of your salary, you effectively double your investment instantly due to the employer match.

- Example

By investing $50 a month into a Roth IRA that averages a 7% annual return, in 40 years, you could have over $120,000, demonstrating the power of compound interest over time.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Money Book for the Young, Fabulous & Broke Summary: Common Questions

"You are not what you drive, wear, or live in; you are the sum total of your choices."

I just finished reading The Money Book for the Young, Fabulous & Broke by Suze Orman. The book offers practical advice on managing finances, tackling debt, and building wealth. Orman's emphasis on empowering young adults to take control of their financial futures was both inspiring and eye-opening. However, some of her recommendations, like investing in the stock market without much guidance, left me a bit hesitant.

Overall, the book was a great starting point for anyone looking to improve their financial literacy and make smarter money decisions. If you enjoyed books like "Rich Dad, Poor Dad" by Robert Kiyosaki or "The Total Money Makeover" by Dave Ramsey, you'll likely find value in Orman's insights as well.

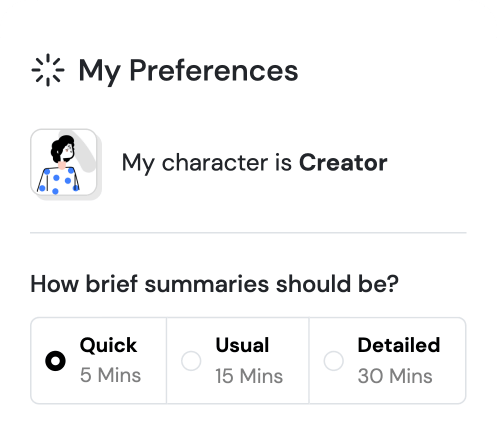

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh