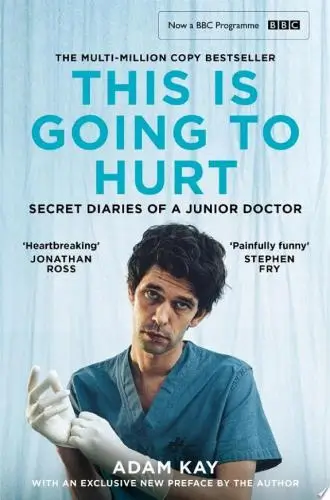

The Total Money Makeover

A Proven Plan for Financial Fitness

What's it about?

The Total Money Makeover offers a straightforward approach to managing your finances, emphasizing the importance of eliminating debt and building wealth. You'll explore seven baby steps that guide you from creating an emergency fund to achieving financial freedom. Ramsey emphasizes living within your means, using a zero-based budget, and avoiding new debt. It's an action-oriented book that provides practical advice and real-life success stories to motivate and guide you towards financial stability and growth.

About the Author

Dave Ramsey is a personal finance expert known for his straightforward approach to debt elimination and wealth building. Author of "The Total Money Makeover," his teachings emphasize the importance of budgeting, avoiding debt, and investing wisely. Ramsey's work is characterized by practical advice and motivational support for financial discipline.

10 Key Ideas of The Total Money Makeover

Create a $1,000 Emergency Fund for Life's Unexpected Events

An initial emergency fund of $1,000 is crucial as a financial safety net for unforeseen expenses, such as car repairs or medical bills.

This prevents the need to go into debt for emergencies, ensuring that minor setbacks don't derail your entire financial plan.

It acts as a buffer between you and life's surprises, allowing you to focus on debt repayment without adding new debt.

Learn DeeperAutomatically save a small portion of your paycheck: Set up an automatic transfer from your checking account to a savings account dedicated to your emergency fund. Even starting with $50 or $100 per month can build up over time.

Cut back on non-essential expenses: Review your monthly spending and identify areas where you can cut back, such as dining out, subscription services, or luxury items. Redirect these funds to your emergency savings.

Sell unused items: Look around your home for items you no longer use or need, such as electronics, clothes, or furniture. Selling these items can provide a quick boost to your emergency fund.

Adjust your tax withholdings: If you typically receive a large tax refund, consider adjusting your withholdings so you receive more in your paycheck each month. Allocate this extra money directly to your emergency fund.

Take on a side job or freelance work: If possible, find additional sources of income that can be dedicated entirely to building your emergency fund. This could be anything from part-time work to selling handmade goods online.

- Example

Imagine you're reviewing your monthly expenses and notice you spend $100 on coffee and eating out. By reducing this expense by half, you can redirect $50 each month to your emergency fund, gradually building it up without significantly impacting your lifestyle.

- Example

Consider a scenario where you receive a yearly tax refund of $1,200 due to over-withholding. By adjusting your withholdings to more accurately reflect your tax liability, you could have an extra $100 per month. Directing this amount to your emergency fund can help you reach your $1,000 goal more quickly.

Use the Debt Snowball Method to Pay Off All Debt Except the House

The Debt Snowball method involves listing all debts from smallest to largest (regardless of interest rate).

You pay minimum payments on all but the smallest debt and throw as much money as possible at the smallest debt until it's paid off.

Then, move to the next smallest debt, applying the previous payment plus any extra funds.

This method creates quick wins, building momentum and motivation to pay off all debts more efficiently.

Learn DeeperList all your debts: Start by writing down every debt you have, from the smallest to the largest. This includes credit card debt, personal loans, car loans, and any other debts, excluding your mortgage.

Budget for minimum payments: Ensure your budget allows for the minimum payments on all your debts. This step is crucial to keep all your accounts in good standing while you focus on aggressively paying off one debt at a time.

Identify extra funds: Look for areas in your budget where you can cut back, such as dining out, subscriptions you don’t use, or unnecessary shopping. Redirect these savings towards your smallest debt.

Pay off the smallest debt: Use all the extra funds you've identified plus the minimum payment, and direct them towards your smallest debt until it's fully paid off. Celebrate this win – it’s a big step towards financial freedom!

Roll over payments to the next debt: Once the smallest debt is paid off, take the entire amount you were paying on that debt (minimum payment plus any extra funds) and apply it to the next smallest debt. Continue this process, like a snowball rolling and growing, until all your debts are paid off.

- Example

If you have three debts: a $500 medical bill, a $2,000 credit card debt, and a $10,000 car loan, you would start by focusing all extra payment efforts on the $500 medical bill. Once that's paid off, you move to the $2,000 credit card debt, applying the money you were paying on the medical bill plus any additional funds you can find.

- Example

Imagine you're paying a minimum of $50 on a $500 credit card debt, $100 on a $2,000 personal loan, and $200 on a $5,000 car loan. After paying off the $500 credit card debt using extra funds from your budget, you then apply the $50 you were paying on that card, plus any extra money, to the $100 minimum payment on the personal loan, making it $150 (or more) towards the personal loan until it's paid off.

Save 3 to 6 Months of Expenses in a Fully Funded Emergency Fund

After clearing non-mortgage debt, the next step is to expand your emergency fund to cover 3 to 6 months of living expenses.

This larger safety net ensures you can withstand longer periods of financial hardship, such as job loss or significant medical issues, without falling back into debt.

It provides peace of mind and financial stability, allowing you to handle life's challenges without financial stress.

Learn DeeperTrack Your Monthly Expenses: Start by keeping a detailed record of all your monthly expenses for at least two months. This includes rent or mortgage, utilities, groceries, insurance, and any other recurring payments. Understanding where your money goes is the first step in knowing how much you'll need to save.

Set a Monthly Savings Goal: Based on your tracked expenses, calculate an average monthly cost. Then, set a goal to save a portion of that amount each month towards your emergency fund. For example, if your monthly expenses are $3,000, aim to put aside $300-$600 each month until you reach your target.

Open a Separate Savings Account: To avoid the temptation of dipping into your emergency fund for non-emergencies, open a savings account specifically for this purpose. Look for one with a good interest rate but easy access in case of an actual emergency.

Automate Your Savings: Set up an automatic transfer from your checking to your emergency savings account right after payday. This makes saving effortless and ensures you're consistently building your fund.

Review and Adjust Regularly: Life changes, and so will your expenses. Make it a habit to review your emergency fund at least once a year to ensure it still covers 3 to 6 months of your current living expenses. Adjust your savings goal as needed.

- Example

Jane, a graphic designer, calculates her monthly living expenses to be around $2,500. After paying off her credit card debt, she decides to build her emergency fund. She sets up an automatic transfer of $250 to a high-yield savings account every payday, aiming to reach her minimum goal of $7,500 (3 months of expenses) within 30 months.

- Example

Alex and Sam, a married couple, have combined monthly expenses of $4,000. After clearing their car loan, they focus on their emergency fund. They decide to save $800 a month in a separate account. In just over 15 months, they achieve their initial target of $12,000, covering 3 months of expenses, and continue saving to reach their 6-month goal.

Invest 15% of Household Income into Roth IRAs and Pre-Tax Retirement Funds

Investing 15% of your household income into retirement accounts like Roth IRAs and 401(k)s is essential for building wealth over the long term.

This strategy balances the need to save for retirement while still working on other financial goals.

It leverages the power of compound interest, ensuring a comfortable retirement.

Diversifying investments across pre-tax and post-tax options also helps manage future tax liabilities.

Learn DeeperStart by evaluating your current financial situation. Before you can begin investing 15% of your household income into retirement accounts, it's crucial to know where you stand financially. Create a detailed budget that tracks all your income and expenses. This will help you identify how much you can realistically set aside for retirement savings each month.

Open a Roth IRA and/or 401(k) account. If you don't already have these accounts, now is the time to set them up. For a Roth IRA, look for institutions that offer low fees and a wide range of investment options. If your employer offers a 401(k) plan, especially one with a matching contribution, make sure to take full advantage of it as part of your 15% investment strategy.

Automate your contributions. To ensure you consistently invest 15% of your income, automate your contributions to your retirement accounts. This can usually be done through your bank or directly with your employer for a 401(k). Automating helps you stay disciplined with your savings without having to think about it each month.

Diversify your investments within your retirement accounts. Don't put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, mutual funds) to reduce risk and increase potential returns over the long term. Consider speaking with a financial advisor to tailor your investment strategy to your age, goals, and risk tolerance.

- Example

Imagine you're earning $50,000 a year. Investing 15% of your household income means you should aim to put away $7,500 annually into your retirement accounts. You decide to split this between a Roth IRA ($3,750) and your employer's 401(k) plan ($3,750), taking advantage of your employer's 3% match on your 401(k) contributions.

- Example

Sarah, a freelance graphic designer, earns a variable income averaging $60,000 annually. She opens a Roth IRA and decides to contribute a fixed amount monthly to meet her 15% goal by year-end. Knowing her income can fluctuate, she sets up a high-yield savings account as a buffer. During months when she earns more, she contributes extra to her Roth IRA, ensuring she hits her target of $9,000 in retirement savings for the year.

Save for Your Children's College Fund Using Tax-Advantaged Savings Plans

Setting aside money for your children's education through tax-advantaged savings plans, such as 529 plans or ESAs (Education Savings Accounts), can significantly reduce the burden of student loans in their future.

Investing in these plans early takes advantage of compound growth, potentially covering a substantial portion of college expenses and allowing your children to start their adult lives without debilitating debt.

Learn DeeperStart Early: The sooner you begin saving in a 529 plan or ESA, the more your investment can grow through compound interest. Even small contributions can add up over time.

Research and Choose the Right Plan: Not all 529 plans and ESAs are created equal. Look into the specific tax advantages, contribution limits, and investment options of plans available in your state or offered by financial institutions.

Automate Contributions: Set up automatic transfers from your checking account to the college fund. This ensures consistent savings and reduces the temptation to skip contributions.

Involve Family Members: Encourage grandparents or other relatives to contribute to your child's college fund instead of giving traditional gifts for birthdays or holidays.

Monitor and Adjust: Regularly review the performance of your investments in the 529 plan or ESA. Be prepared to adjust your strategy based on changes in the market or your financial situation.

- Example

If you start saving $100 a month in a 529 plan when your child is born, assuming an average annual return of 7%, you could have over $38,000 by the time they turn 18.

- Example

A family decides to redirect their yearly tax refund into their child's ESA, adding an extra $2,000 to the fund annually. This boost helps them reach their college savings goal faster and takes advantage of the tax-free growth offered by the account.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Total Money Makeover Summary: Common Questions

"The Total Money Makeover is not theory. It works every single time." - Dave Ramsey

I just finished reading The Total Money Makeover by Dave Ramsey, and it completely captivated me with its no-nonsense approach to personal finance. Ramsey's emphasis on getting out of debt, living below your means, and building wealth through practical steps like budgeting and investing really resonated with me. His straightforward advice and motivational tone kept me engaged throughout the book.

While some of Ramsey's ideas may seem radical, like his "debt snowball" method of paying off debts from smallest to largest regardless of interest rates, the book presents a refreshing perspective on how to take control of your finances. If you enjoyed books like "Rich Dad Poor Dad" by Robert Kiyosaki or "The Millionaire Next Door" by Thomas J. Stanley, you'll likely find The Total Money Makeover to be a valuable addition to your personal finance library. Overall, I highly recommend this book to anyone looking to transform their financial situation.

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

The Art of Spending Money

Morgan Housel

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave RamseyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh