The Founder's Dilemmas

Anticipating and Avoiding the Pitfalls That Can Sink a Startup

What's it about?

The Founder's Dilemmas dives deep into the critical decisions founders face, balancing between wealth and control. Wasserman uses real-world examples to explore how early choices can lead to success or failure. This book is your roadmap to navigate the tricky waters of entrepreneurship, highlighting the importance of understanding the consequences of every decision. A perfect blend of research and practical advice, it's an invaluable guide for shaping the future of your startup.

About the Author

Noam Wasserman is an academic and author specializing in entrepreneurship. His seminal work, "The Founder's Dilemmas," examines the challenges faced by entrepreneurs. Wasserman's research focuses on decision-making and leadership in startups, offering insights into navigating the complex dynamics of founding teams and venture success. His writing blends rigorous analysis with practical advice.

10 Key Ideas of The Founder's Dilemmas

Embrace the Paradox of Rich vs. King to Make Enlightened Decisions

Founders often face a critical choice between wealth (being 'rich') and control ('being king').

Opting for wealth may mean accepting external investment and diluting ownership, which can accelerate growth but reduce control.

Conversely, prioritizing control keeps decision-making power intact but might limit financial resources and growth potential.

Understanding this paradox is crucial for making decisions that align with personal and business goals.

Founders should assess their priorities early on to navigate this dilemma effectively, ensuring they make choices that support their long-term vision for the company.

Learn DeeperDefine Your Priorities Early On: Take some time to reflect on what matters most to you in your entrepreneurial journey. Is it the control over your creation, or is it the potential financial rewards? Understanding your priorities will guide your decision-making process.

Seek Balanced Investment Options: Look for investors who understand and respect your vision for the company. Some investors are more willing to offer strategic guidance without demanding significant control. Finding the right partners can help you maintain a balance between growth and control.

Consider Alternative Funding Sources: Explore funding options beyond traditional venture capital, such as bootstrapping, crowdfunding, or angel investing. These alternatives might offer the financial boost you need without significant sacrifices in control.

Regularly Reassess Your Goals and Strategy: As your business evolves, so too might your priorities. Make it a habit to periodically reassess your goals and strategy to ensure they still align with your vision of being 'rich' versus 'king'.

Communicate Openly with Stakeholders: Whether you're leaning towards 'rich' or 'king', clear communication with your team, investors, and other stakeholders is crucial. This ensures everyone is aligned with the company's direction and your decision-making rationale.

- Example

A tech startup founder initially prioritizes control to develop the product according to their vision. They opt for bootstrapping and small angel investments that don't require giving up equity. As the product matures and market expansion becomes a priority, the founder reassesses their goals and decides to seek venture capital, accepting diluted ownership for significant growth.

- Example

An entrepreneur with a social media platform chooses to remain king by retaining control over all major decisions. They focus on slow, organic growth and community building, avoiding external investments that could force a shift in the company's direction. Over time, as the platform gains traction, they selectively partner with investors who are aligned with their vision and values, ensuring they can still prioritize control while accessing funds for growth.

Harness the Power of Vesting to Align Interests and Protect the Future

Implementing vesting schedules for equity ensures that co-founders and early employees remain committed to the company over a specified period.

This tactic prevents scenarios where individuals leave prematurely while retaining significant equity, potentially harming the company's future prospects.

Vesting aligns team members' interests with the long-term success of the business, encouraging sustained contribution and loyalty.

It also provides a mechanism for fairly redistributing equity if someone departs earlier than expected, thereby protecting the company and its remaining contributors.

Learn DeeperDraft a Clear Vesting Agreement: Start by creating a vesting schedule that outlines how equity will be distributed over time. Typically, this includes a 'cliff' period (usually one year) after which the first portion of equity vests, followed by monthly or quarterly increments.

Communicate Openly with Your Team: Ensure that all parties involved understand the terms of the vesting agreement. This transparency helps manage expectations and fosters a culture of commitment and trust within the team.

Regularly Review and Adjust the Vesting Schedule: As your company grows and evolves, so too may your team's roles and contributions. Be prepared to revisit and adjust the vesting agreements to reflect these changes, ensuring they continue to align with the company's goals and values.

Implement a Buyback Clause: In case a team member decides to leave before their equity is fully vested, include a clause that allows the company to buy back unvested shares at the original price. This protects the company's equity structure and rewards those who stay and contribute to its growth.

- Example

A tech startup implements a four-year vesting schedule with a one-year cliff for its co-founders. This means that if any co-founder decides to leave within the first year, they forfeit their equity. After the cliff, 25% of their equity vests, with the remainder vesting monthly over the next three years.

- Example

A small business introduces a vesting schedule for its early employees, offering equity that vests over three years with a six-month cliff. This encourages employees to stay with the company during its critical growth phase, aligning their interests with the long-term success of the business.

Cultivate a Strong Founding Team with Complementary Skills and Shared Vision

The strength of a founding team lies in its diversity of skills and unity of vision.

A mix of technical, business, and interpersonal skills ensures that the team can tackle various challenges, from product development to market strategy and customer relations.

However, it's equally important that all members share a common vision and values for the company's direction.

This combination fosters a productive working environment, facilitates effective decision-making, and enhances the team's ability to execute the business plan successfully.

Regular communication and alignment exercises can help maintain this balance.

Learn DeeperIdentify Your Strengths and Weaknesses: Take time to assess your own skills and those of your potential co-founders. Look for gaps in areas like technical expertise, business strategy, and interpersonal skills. This will help you understand what skills you need to look for in others.

Seek Complementary Partners: Once you know what skills you're missing, actively seek out individuals who can fill those gaps. Networking events, industry conferences, and online platforms can be great places to meet potential co-founders.

Establish a Shared Vision Early On: Before diving into the nitty-gritty of your business, make sure all founding members are aligned on the company's long-term goals and values. This can be achieved through open discussions and regular check-ins.

Foster Open Communication: Encourage a culture of transparency and regular communication among team members. This can involve weekly meetings, shared progress reports, or even informal catch-ups to ensure everyone is on the same page.

Conduct Alignment Exercises: Regularly revisit your company's vision and goals as a team. This could be through retreats, strategy sessions, or feedback loops. It ensures that as your business evolves, your team's alignment does too.

- Example

A tech startup where one founder is an expert in software development while another excels in marketing and a third specializes in operations. They hold weekly meetings to ensure their strategies align with the company's vision.

- Example

A social enterprise where the founders come from diverse backgrounds - one from non-profit management, another from finance, and a third from community organizing. They conduct quarterly retreats to realign on their mission and adjust their approach based on new insights.

Anticipate and Strategically Plan for Role Evolution Within the Startup

As startups grow, the roles and responsibilities of the founding team will inevitably evolve.

Founders must anticipate these changes and plan accordingly to ensure smooth transitions.

This might involve acquiring new skills, delegating tasks, or even stepping down from certain roles to bring in more experienced executives.

Being open to role evolution is crucial for personal growth and the company's success.

Early planning and flexibility allow for adapting to the startup's changing needs without disrupting its progress.

Learn DeeperRegularly Evaluate Your Role and Skills: Every few months, take a step back to assess your current role within the startup. Ask yourself if your skills still match the company's needs or if there's a gap that needs filling. This could mean taking online courses to improve your knowledge or seeking mentorship in areas you're less familiar with.

Create a Flexible Role Plan: Draft a plan that outlines potential future roles you and your co-founders might transition into as the company grows. Include criteria for when it might be time to consider bringing in external expertise or promoting from within.

Foster Open Communication: Encourage an environment where team members can openly discuss their aspirations, strengths, and weaknesses. This will make it easier to adapt roles based on individual growth and the evolving needs of the startup.

Embrace Delegation: As the company expands, it's crucial to delegate tasks to maintain focus on strategic goals. Identify tasks that can be handed off to other team members or new hires, freeing up your time for more critical responsibilities.

- Example

A tech startup founder realizes her company is scaling rapidly and the operational demands exceed her expertise. She decides to hire a COO with experience in scaling businesses, allowing her to focus on product development and strategy.

- Example

Another founder of a small e-commerce business notices he's spending too much time on day-to-day customer service inquiries, which hampers his ability to work on business growth. He trains and delegates these tasks to a trusted team member, enabling him to concentrate on marketing and expansion strategies.

Prioritize Transparent Communication to Foster Trust and Resolve Conflicts

Transparent communication is vital in building trust among co-founders and team members.

It involves openly sharing information, expectations, and concerns, as well as providing constructive feedback.

This transparency helps prevent misunderstandings and conflicts, which are common in high-pressure startup environments.

When issues do arise, a culture of openness ensures they can be addressed promptly and effectively, preventing them from escalating and harming the team's cohesion or the company's trajectory.

Learn DeeperSchedule Regular Check-ins: Set up weekly or bi-weekly meetings with your co-founders and team members to discuss ongoing projects, address any concerns, and share updates. This routine ensures everyone is on the same page and fosters a culture of openness.

Create a Feedback Loop: Implement a system where feedback can be given and received constructively. This could be through anonymous surveys, one-on-one meetings, or a dedicated time during team meetings. Encourage honesty while maintaining respect.

Document and Share Decisions: Whenever decisions are made, especially those affecting the team or company direction, document them and share with the relevant parties. This avoids confusion and ensures everyone understands the rationale behind certain actions.

Foster an Environment of Psychological Safety: Encourage team members to speak up without fear of retribution. Make it clear that all ideas and concerns are welcome, and that addressing issues openly is valued over silent compliance.

- Example

A tech startup implements a 'Friday Reflection' session where team members share their wins, challenges, and learnings from the week. This practice not only keeps everyone informed but also celebrates successes and openly discusses setbacks.

- Example

A co-founding team agrees to a 'No Surprises' rule, where they commit to sharing significant information or changes in personal commitment levels as soon as possible. This agreement helps maintain trust and allows for early adjustments to plans.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Founder's Dilemmas Summary: Common Questions

"There are no universal answers, only situation-specific ones." This quote from The Founder's Dilemmas encapsulates the essence of this insightful book, which delves into the challenges faced by entrepreneurs when starting and growing their ventures. Wasserman explores the trade-offs and decisions founders must make regarding co-founders, equity splits, investors, and other crucial aspects that can significantly impact the success or failure of a startup.

The book presents real-life case studies and research findings that shed light on the complexities of navigating these dilemmas. It offers practical advice and frameworks to help founders make more informed choices as they navigate the precarious journey of building a company. Wasserman's thorough analysis of the risks and rewards associated with different decisions provides valuable insights for both aspiring and seasoned entrepreneurs.

The Founder's Dilemmas is a must-read for anyone interested in entrepreneurship and the intricacies of building a successful startup. Its practical insights, research-based approach, and engaging storytelling make it a valuable resource for founders looking to avoid common pitfalls in their entrepreneurial journey.

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Emotional Intelligence at Work

Dalip Singh

Seeing the Big Picture

Kevin Cope

Leadership Is Concept Heavy

Dr. Enoch Antwi

Great by Choice

Jim Collins

The Leader′s Guide to Coaching in Schools

John Campbell

Preparing School Leaders for the 21st Century

Stephan Gerhard Huber

The E-Myth Manager

Michael E. Gerber

Leadership Is Language

L. David Marquet

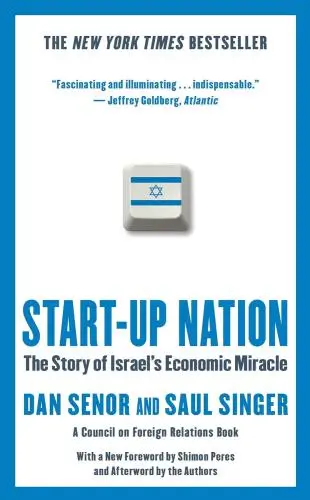

Start-up Nation

Dan SenorTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh