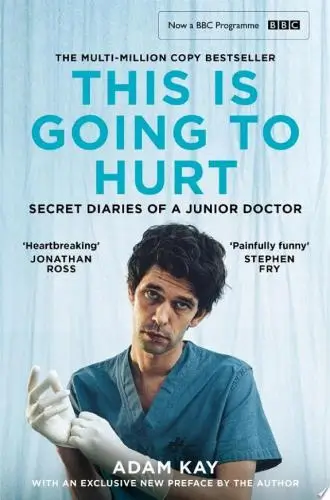

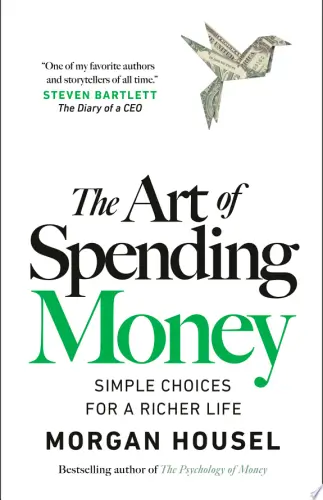

The Art of Spending Money

Simple Choices for a Richer Life

What's it about?

The Art of Spending Money by Morgan Housel explores the psychology and philosophy behind how you manage your finances. Housel emphasizes that spending is a deeply personal choice influenced by your values and experiences. You'll learn to align your expenditures with what truly brings you joy, rather than falling prey to societal pressures. The book encourages you to rethink your relationship with money, helping you to make informed decisions that reflect your priorities. By the end, you'll be inspired to spend in ways that enhance your life meaningfully.

About the Author

Morgan Housel is an author and financial journalist known for his insightful writings on investing, behavioral finance, and personal finance. He has written for prominent publications like The Wall Street Journal and The Motley Fool. Housel has also worked as a columnist at The Motley Fool and The Collaborative Fund. His book, "The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness," became a New York Times bestseller. With a focus on understanding the human side of finance, Housel's work provides valuable insights into the intersection of psychology and investing.

5 Key Ideas of The Art of Spending Money

The Happiness-Money Paradox

Spending money in ways that align with your values brings more joy than accumulating wealth for its own sake.

Imagine a person buying a flashy car they can't maintain just to impress others, only to find more satisfaction investing in a hobby that brings genuine joy.

- Aligns spending with personal values increases long-term satisfaction.

- Experiential spending, like travel or learning, often provides more happiness than material acquisitions.

- Meaningful spending fosters a sense of purpose and personal fulfillment.

Evaluate your last five non-essential purchases and note which ones align with your true values.

Don't chase societal definitions of success; clarify your own values and focus spending there.

Mastering Emotional Spending

Understanding how emotions influence spending can prevent impulsive decisions and financial regret.

Think of the rush from a spontaneous shopping spree, only to feel the sting of buyer's remorse when faced with the credit card bill.

- Emotional awareness curbs impulsivity, leading to more deliberate financial choices.

- Recognizing emotional triggers helps build healthier spending habits.

- Practical strategies, like waiting periods, provide perspective before major purchases.

Implement a 24-hour wait rule before making non-essential purchases over a set amount.

Avoid justifying impulsive buys as 'rewards'; instead, find healthier ways to handle emotions.

Investing in Experiences Over Things

Experiences enrich our lives and create lasting memories far beyond the thrill of acquiring objects.

Recall the difference in joy from a concert with friends compared to a shiny gadget that soon gathers dust.

- Experiences strengthen social bonds, fostering better relationships.

- Memory of experiences typically endures longer than the novelty of new possessions.

- Experiential spending is linked to higher long-term happiness.

Plan your next month's discretionary budget around activities or experiences instead of objects.

Don't assume more expensive experiences equate to better; focus on meaningful and enriching.

Deeper knowledge. Personal growth. Unlocked.

Unlock this book's key ideas and 15M+ more. Learn with quick, impactful summaries.

Read Full SummarySign up and read for free!

The Art of Spending Money Summary: Common Questions

“Money is a tool, not a goal.” This quote from Morgan Housel's The Art of Spending Money encapsulates the essence of the book. Housel delves into the psychology behind how we view and use money, encouraging readers to shift their mindset from mere accumulation to focused spending that enhances life. His exploration of the relationship between wealth and happiness was particularly enlightening, as he emphasizes that true satisfaction often comes from the experiences money can buy, rather than the money itself.

One concept that left me scratching my head was the idea that, in our pursuit of financial security, we often forget to enjoy the journey. Housel shares captivating anecdotes, revealing that the people who manage to find joy in spending — whether on travel, education, or even hobbies — often report the greatest fulfillment. This notion made me reconsider how I allocate my own resources and whether I prioritize spending in a way that aligns with my values and aspirations.

Overall, I found The Art of Spending Money to be a thought-provoking read, reminiscent of Your Money or Your Life but with a more nuanced approach to the emotions tied to financial decisions. If you're looking to rethink your relationship with money and prioritize what truly matters, I highly recommend picking this book up.

Experience Personalized Book Summaries, Today!

Discover a new way to gain knowledge, and save time.

Sign up for our 7-day trial now.

No Credit Card Needed

Similar Books

Forex Trading QuickStart Guide

Troy Noonan

Trading in the Zone

Mark Douglas

Doughnut Economics

Kate Raworth

A study guide for Barbara Ehrenreich's "Nickel and Dimed: On (Not) Getting By in America"

Gale, Cengage Learning

Bitcoin For Dummies

Prypto

Debt

David Graeber

The Barefoot Investor

Scott Pape

Money Has No Value

Samuel A. Chambers

Financial Peace

Dave Ramsey

Capital in the Twenty-First Century

Thomas PikettyTrending Summaries

Peak

Anders Ericsson

Never Split the Difference

Chris Voss

Smart Brevity

Jim VandeHei

The Psychology of Money

Morgan Housel

The First 90 Days

Michael D. Watkins

Atomic Habits

James Clear

Thinking, Fast and Slow

Daniel Kahneman

The Body Keeps the Score

Bessel van der Kolk M.D.

The Power of Regret

Daniel H. Pink

The Compound Effect

Darren HardyNew Books

Forex Trading QuickStart Guide

Troy Noonan

Comprehensive Casebook of Cognitive Therapy

Frank M. Dattilio

The White Night of St. Petersburg

Michel (Prince of Greece)

Demystifying Climate Models

Andrew Gettelman

The Hobbit

J.R.R. Tolkien

The Decision Book

Mikael Krogerus

The Decision Book: 50 Models for Strategic Thinking

Mikael Krogerus

Fichte

Johann Gottlieb Fichte

Do No Harm

Henry Marsh